Why John Lewis is now supplying personal savings and financial investment services | Enterprise Information

5 min readThe first reaction to news that the John Lewis Partnership has started giving cost savings and investment decision services is – what took it so long?

Just about every survey or view poll suggests John Lewis is one particular of the most, if not the most, dependable and admired makes in the place.

At the close of 2020, the pollster YouGov exposed the retailer experienced topped its Most effective Brand rankings in the British isles for the fourth consecutive calendar year, irrespective of its retailers staying closed for considerably of the previous 9 months and in spite of the partnership obtaining not long ago introduced 1,500 task cuts.

So this is an enormously resilient brand and a single intimately reliable by buyers.

Giving financial investment expert services, where trust is much more important than just about anything, is consequently a reasonable brand extension.

It is all the a lot more rational offered that John Lewis by now provides credit score expert services as a result of its Partnership Card and also sells property, auto and pet insurance.

The retailer simply cannot be accused of hurrying its fences.

It introduced a economical expert services arm in 2006 under the identify Greenbee that was widely anticipated at the time to start featuring personal savings and financial investment merchandise.

It never took place and the Greenbee manufacturer was retired just four several years afterwards.

The original products assortment will be really a minimal one particular.

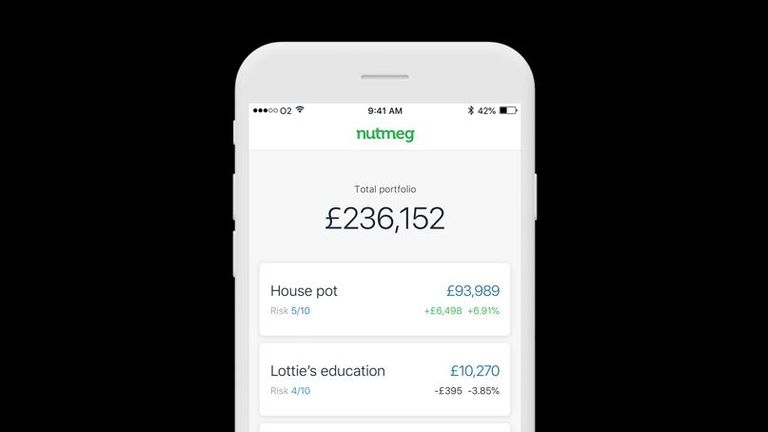

Presented in partnership with Nutmeg, the digital prosperity manager and so-called “robo-information” firm not too long ago obtained by US banking colossus JP Morgan Chase, it contains a Junior ISA, a stocks and shares ISA and, for people consumers who have by now utilized up their once-a-year £20,000 ISA allowance, a typical investment decision account.

All will be primarily based about cash in the environmental, social and governance (ESG) field.

Robo-advisers are very low-price tag digital platforms which acquire details from buyers on the hazard they are prepared to take, along with their financial savings ambitions, ahead of instantly investing their cash appropriately.

Anyone anticipating to be in a position to stroll into a John Lewis division keep and sit down with a fiscal adviser, as they may possibly get specialist tips in the haberdashery office, is going to be dissatisfied.

The transfer, portion of a push to quadruple the dimension of the partnership’s monetary services company during the upcoming 5 many years, is fascinating in its timing.

It comes as a quantity of merchants have really pared back again their fiscal providers organizations.

Tesco reported previously this year that it would be closing all of its present accounts, a provider it launched seven many years in the past, by the finish of November, getting now shut the service to new accounts in 2019.

That calendar year also saw the grocery store offload its home loans enterprise to Lloyds Banking Team for £3.8bn and noticed its rival Sainsbury’s halt providing mortgages to new customers.

It has since been claimed that Sainsbury’s is looking to offer its full banking procedure.

Marks & Spencer, meanwhile, is also to stop furnishing recent accounts at the finish of this month and has presently started closing its in-retail outlet branches despite the fact that it has ongoing to provide credit history cards, insurance policies, discounts and bank loan products and services on-line.

The retrenchments discuss volumes about the intensity of opposition in products and services like latest accounts and mortgages.

These solutions are dominated by the professional banks and, even with their wide market place shares, they have struggled to make sustainable income from them at a time of in the vicinity of-zero desire prices.

That almost certainly describes why John Lewis is concentrating on the possibly more rewarding products space of savings and investments.

However this area is no a lot less competitive.

A plethora of founded expense platforms supply shares and shares ISAs and other so-termed “fund grocery store” providers, amongst them Hargreaves Lansdown, AJ Bell, Fidelity and Interactive Trader.

These are all massive, dominant gamers.

Hargreaves Lansdown by itself has additional than 1 million ISA account holders on its platform.

In the meantime, the large 4 industrial banking institutions – NatWest, Barclays, Lloyds and HSBC – all supply shares and shares ISAs and, with consumers attaining at any time extra worthless returns from cash cost savings accounts, have been producing a concerted push into the personal savings and investments house.

The sharp rise in stock marketplaces throughout the past 12 months and the rising reputation of share buying and selling between a more youthful generation of buyers has fed into that.

Barclays teamed up in July last 12 months with another robo-advice agency, Scalable Capital, to give a digital prosperity management provider.

Meanwhile just this week Lloyds – also an founded participant in regular prosperity administration by way of a a few-12 months aged partnership with the fund supervisor Schroders – declared it was buying Embark Group, a robo-tips service provider, for £390m.

The Fiscal Carry out Authority predicted final 12 months that all of the industrial banking institutions will offer robo-guidance companies soon.

The regulator, in a report posted in December, mentioned: “It is expected that all the big retail banks will have an automated assistance proposition in just the subsequent couple many years.

“Supplied their current shopper foundation, retail banking companies will be capable to market place their expert services specifically to their current prospects.

“Shoppers may perhaps be a lot more inclined to trust an recognized brand name and the entry of retail banking companies into the market may catch the attention of a lot more very first-time buyers.”

John Lewis is plainly hoping that, with the strength of its brand, the FCA’s logic will also apply to its price savings and financial investment choices.

That there is an addressable marketplace out there is past dispute.

The FCA report famous that only 1.3% of British isles grown ups had utilised a service provider of automatic on line investment and pension expert services through the past 12 months and mentioned the assets less than administration accounted for much less than .5% of the retail expense market.

The regulator also noticed that, while there was far more consciousness of automatic financial commitment information solutions, just 19% of older people knew about them.

It additional: “Lack of model awareness is still a barrier for people.”

So John Lewis is concentrating on a massive current market and the energy of its manufacturer might confirm to be a crucial factor in attracting consumers.

The nagging concern, even though, is why it expects to make headway in this unique subject when it has these small effect in a sector, like coverage, in which it has been a player for 15 years now.