Why economical markets are now largely embracing the Biden period | Company Information

5 min readThe US election end result last November was, been given wisdom experienced it, just about the perfect consequence for Wall Street.

No a lot more would traders have to wake up wanting to know what Donald Trump experienced just tweeted and what clean unpredictability he would be unleashing on markets.

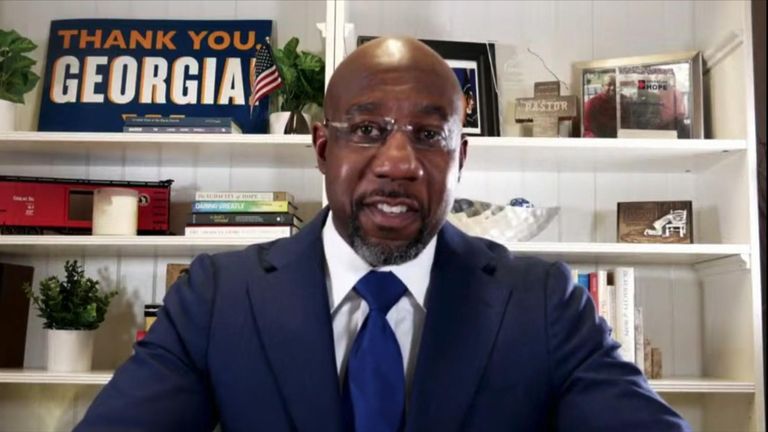

Observe reside updates as Ga set to give Democrats the Senate

Joe Biden, it was assumed, would guide to a calmer ride for marketplaces when also ending some of the trade disputes Mr Trump started out or exacerbated with China and the EU.

At the very same time, the failure of the Democrats to earn handle of the US Senate was also regarded reassuring for buyers, because it would suppress the excesses of the extra still left-wing features in Mr Biden’s celebration.

Republican management of Senate, it was hoped, would also prevent Mr Biden from pushing by means of some of the tax will increase that he promised all through the election marketing campaign.

But adhering to the Georgia run-off, the Democrats now look like possessing manage of the Senate, potentially making it less complicated for Mr Biden to go after some of his policy goals.

To that backdrop, a big offer-off in the US inventory marketplace may have been expected, but it does not appear to have materialised still.

Why? There are a pair of causes. The very first is that, with the Democrats possessing manage of Congress as nicely as the White Household, the US economy can count on an even bigger fiscal stimulus than it would have formerly.

The US Treasury is in the course of action of sending out $600 cheques to each and every American but Mitch McConnell, the Republican Senate leader, blocked makes an attempt to increase the amounts currently being compensated out. Mr Biden, meanwhile, has promised to send out out cheques of $2,000 apiece and explained the $600 cheques as a “down-payment”.

So there could be a superior offer a lot more shelling out. The investment decision financial institution Goldman Sachs is predicting a more $600bn well worth of stimulus actions on leading of the a short while ago-agreed $900bn offer.

Appropriately, there have been big share value gains for firms that would advantage from a increase in infrastructure investment, these kinds of as the aggregates producers Vulcan Resources and Martin Marietta, the truck-maker Paccar, the digger manufacturer Caterpillar, the making devices provider United Rentals and the industrial conglomerate Normal Electric powered.

With Mr Biden possible to force more difficult for decarbonisation, there have also been gains for the likes of Albemarle Corp, a main producer of lithium for electric powered car batteries, the nuclear electricity company Exelon and the electric powered vehicle-maker Tesla.

A further prospective beneficiary of a Democrat clean sweep now has been the banking sector.

This is because a even bigger fiscal stimulus is viewed as inflationary. That could pressure the US Federal Reserve into increasing curiosity charges far more rapidly than would usually have been the case, which is great information for the banking sector, whose profitability has been crushed by in close proximity to-zero interest charges.

The fiscal sector was the greatest one gainer on the S&P 500 index on Wednesday afternoon.

The Dow Jones Industrial Regular, in the meantime, has been enjoying its finest just one-day session given that 24 November last year and has strike a history superior.

It is also fascinating to observe that, of all the most important US inventory indices to have rallied this afternoon, the major gains have been viewed in the Russell 2000, the most important index for smaller providers, which are also seen as main beneficiaries of far more house and governing administration paying.

Those people are the probable winners. There are also losers. Shares of house organizations have, for illustration, fallen sharply on considerations that fascination costs might increase before than envisioned.

The greatest potential losers from a Democrat clean up sweep, however, are observed as the tech giants.

Mr Biden threatened them all through the presidential election campaign with heavier regulatory scrutiny and phone calls to restrict the electrical power and affect of the likes of Alphabet – owner of Google – Facebook and Amazon could intensify.

As Paul O’Connor, head of multi-asset at the fund supervisor Janus Henderson Traders, put it: “Problems about regulatory intrusion will weigh most seriously on the media, technological innovation and communications behemoths that dominate US indices.”

James Athey, financial commitment director at the fund supervisor Aberdeen Standard Investments, extra: “Additional strong antitrust regulation and enforcement have the probable to suck the wind out of Massive Tech’s sails at a time where by valuations there now search progressively tricky to justify.”

That is a person concern. A further is larger corporate taxes which, all over again, had been promised by Mr Biden in the election campaign. Nonetheless all those fears may well be overblown and most analysts are coming spherical to the see that radical adjustments to the US tax code may perhaps not materialize.

Even if the Democrats do triumph in Georgia, their the vast majority will be wafer-slender, so Democrats and Republicans in the Senate will even now have to function carefully collectively.

Holger Schmieding, main economist at the financial investment bank Berenberg, explained: “With a 50:50 distribution of seats in the Senate if the Democrats in truth prevail in Georgia, any laws that does not garner some bipartisan aid would have to be backed by the most moderate Democrats in the Senate to come to be legislation. Not all Democrats are in favour of what are known as ‘very progressive’ guidelines in the US.”

Stuart Clark, portfolio manager at Quilter investors, additional: “Any more extraordinary policies could be quickly voted down by rogue senators.”

Apart from huge tech, the asset class that, on the deal with of it, has the most to eliminate from a Democrat clear sweep is Treasuries, or US authorities bonds.

Implicit in a even larger fiscal stimulus is not only additional government borrowing but also an before than envisioned uptick in inflation, the best enemy of mounted income traders. Accordingly, yields (which rise as the selling price drop and falls as the price rises) on US Treasuries have long gone up after the Democrats seemed set to earn in Ga. The yield on 10-year Treasuries rose above 1% for the initially time considering that March very last calendar year.

Equally, amid expectations that the US trade deficit could widen with Democrat manage of Congress and the White Dwelling, the US greenback has fallen. It has slipped to its most affordable level versus the euro due to the fact April 2018 and to its most affordable amount for six many years towards the Swiss franc.

But by earning shrewd nominations, this sort of as that of the former Federal Reserve chairman Janet Yellen as his nominee for US Treasury Secretary,Mr Biden has seemingly absent out of his way to soothe the nerves of investors.

The incoming president will want previously mentioned all else to tackle COVID-19 and to do practically nothing to hamper any restoration.

That is why the in general outlook for marketplaces adhering to a Democrat clean up sweep is considerably much more nuanced than may possibly initial have been assumed.