War in Ukraine is causing a many-sided economic shock

4 min read [ad_1]

Wars are also huge economic shocks. The Vietnam war destabilised US public funds. The Korean war of 1950-53 and the Yom Kippur war of 1973 induced large raises in charges of critical commodities. This time, too, a war specifically involving a big electricity exporter, Russia, and, with Ukraine, an crucial exporter of many other commodities, notably cereals, is raising inflation and resulting in sharp reductions in the serious incomes of buyers. Much more significant, the war has included to presently pervasive stresses on economies, global relations and world governance. The walkout by western ministers and central bankers from very last week’s G20 assembly, as the Russian delegation spoke, was a sobering reminder of our divided environment.

Even ahead of Russia’s invasion of Ukraine, the environment experienced not recovered from the financial expenses of Covid, enable by itself its broader social and political effects. Provide disruptions were pervasive and inflation experienced soared to unexpectedly substantial amounts. Monetary coverage was set to tighten sharply. The chance of recession, worsened by defaults and financial disruption, was substantial. To this had to be additional expanding tensions involving China and the west and their divergent insurance policies on Covid.

This war follows pestilence and threatens famine. With each other these are three of Ezekiel’s 4 “disastrous” judgments of the Lord. Alas, the fourth, dying, follows from the other three.

The war is in sum a multiplier of disruption in an by now disrupted environment. Economically, it operates by using five main channels: greater commodity costs disruption of trade economic instability the humanitarian effects, above all tens of millions of refugees and the plan reaction, notably sanctions. All these points also increase uncertainty.

In its most current evaluation of the earth overall economy, the IMF has duly reduced prospective buyers for financial advancement and lifted its anticipations of inflation for a 2nd time in succession. Following the excitement of the unexpectedly speedy restoration from the Covid-induced recessions of 2020, disappointment has set in. Forecasts for world financial development this 12 months have been minimized by 1.3 percentage factors considering that Oct 2021. For substantial-cash flow nations, the forecast has been lowered by 1.2 share factors and for emerging and producing international locations by 1.3 share details. Estimates of potential output are also normally underneath pre-pandemic anticipations.

Inflation forecasts have also been raised sharply. It is now forecast to access 5.7 for each cent in significant-revenue economies and 8.7 for each cent in emerging and building international locations. Nor is this just the final result of higher commodity prices or other offer shortages. As Jason Furman of Harvard’s Kennedy College insists, this inflation is “demand-pushed and persistent”. As in the 1970s, sturdy need could sustain a wage-price spiral, as staff look for to keep authentic incomes. The Fund argues, from this, that oil is considerably less crucial than it made use of to be, labour markets have transformed, and central banking institutions are independent. All this is legitimate. But the interaction involving coverage faults and supply shocks may perhaps however produce stagflationary havoc.

It is not difficult to think about significantly worse results than people prompt by the Fund in its baseline forecast, since this assumes that the war stays limited to Ukraine, sanctions on Russia do not tighten further more, a much more deadly type of Covid does not get there, the tightening of financial policy is modest and there are no significant financial crises. Any (without a doubt several) of these hopes could go awry.

A substantial concern for human welfare, if not the globe economic system, is the chance of monetary distress in rising and establishing countries, in particular people also hit by larger commodity prices. As the World wide Economical Steadiness Report points out, a quarter of issuers of tricky forex credit card debt now have liabilities trading at distressed degrees. The west should now help crisis-hit rising and creating international locations considerably superior than they have completed in the battle against Covid.

The 1 upside of recent disasters is that absolute dictatorship is getting discredited. The focus of energy in the palms of just one fallible human getting is high danger, at finest, and catastrophic, at worst. The Putin regime is a ghastly reminder of what can materialize in such a dispensation. But Xi Jinping’s attempt to do away with a highly infectious and not particularly dangerous pathogen from his state is yet another signal of what unchecked energy could bring. Democracy has not protected by itself in glory, but its leaders can at the very least be eradicated.

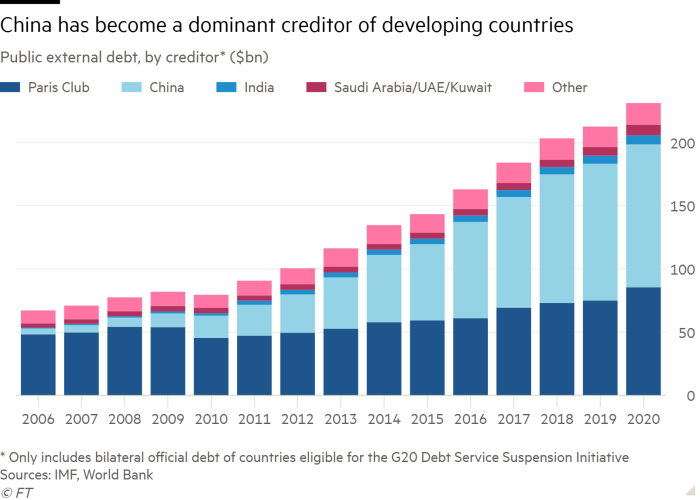

However, alas, we share the earth with these regimes and primarily with that of China. Compared with Russia, China is a superpower, not just a declining electric power with bottomless resentment and 1000’s of nuclear warheads. At the very minimum, the west will require to co-operate with China more than the management of establishing nation personal debt.

Additional essentially, we do need peace, prosperity and defense of the planet. These are not able to be realized with out some degree of co-operation. The Bretton Woods establishments are on their own a monument to the try to reach this. 20-five several years in the past, a lot of hoped we have been on the street toward what humanity essential. Now alas, we are once again on a downhill route to a planet of division, disruption and hazard.

If no further shocks get there, the existing disruptions really should be get over. But we have been reminded that large shocks are feasible and are also virtually often detrimental. Russia need to be resisted. But if we are unable to sustain nominal degrees of co-procedure, the entire world we will stop up sharing is unlikely to be a environment we want to reside in.

Adhere to Martin Wolf with myFT and on Twitter

[ad_2]

Supply website link