The Little Company Expenditure Enterprise System: A Primer

8 min readExecutive Summary

- Above 60 many years, the Tiny Business enterprise Administration has presented almost $70 billion by way of 166,000 investments to America’s small corporations, which include financing for Apple, Intel, and Tesla.

- Licensed Small Enterprise Investment decision Corporations (SBICs) have obtain to a immediate deployment of funds and a adaptable fund structure at generous fascination prices in addition to favorable authorized remedy less than a bevy of laws from Dodd-Frank to the Community Reinvestment Act.

- Even though comparatively modest in scale, the SBIC plan is a person of the finest examples of community-private partnerships, matching government funding with experienced investors exclusively for the purposes of supporting America’s small businesses.

Context

On March 25, 2020, Congress handed the “Phase 3” stimulus package, the Coronavirus Assist, Relief, and Financial Stability (CARES) Act. With an believed $2 trillion rate tag, the 3rd package would be 1 of the greatest and most significant stimulus packages in American record. As portion of this $2 trillion, Congress set apart $349 billion for the aid of tiny companies, to be administered by the Small Company Administration (SBA) in the variety of the Paycheck Protection Program (PPP). In the 12 months given that, the SBA has disbursed $663 billion in forgivable loans to suitable enterprises.

The PPP is not the only instrument available to the SBA, nonetheless, and as Congress considers a fifth legislative bundle attention has concentrated on a much less notable SBA application – the Modest Enterprise Financial commitment Business (SBIC) program. In excess of its lifetime the SBIC has dispersed a lot more than $67 billion in cash by means of 166,000 investments in modest corporations. This total is, of study course, far more compact than the money deployed via the PPP in much significantly less time, but what makes the SBIC exciting is its structure as a fund-of-cash or financial commitment program, in contrast to the forgivable bank loan mechanics of PPP financial loans.

Even though the PPP has been an extraordinarily efficient in stabilizing a pandemic financial state and maintaining little enterprises afloat, it is not earlier mentioned criticism. As Congress considers a fifth legislative package, and if even further expenditure in small companies is vital, lawmakers could take into consideration as an alternative the added benefits that supplementing the SBIC system could supply.

History

The SBA was shaped in 1953 with the signing of the Modest Company Act by President Dwight D. Eisenhower to “aid, counsel, assist and guard, insofar as is feasible, the pursuits of tiny business enterprise worries.” As a key aspect to this mission, in 1958 the SBA released the SBIC application and began licensing SBICs. The SBA delivered financing (known as leverage) to its SBICs through the issuance of unsecured financial loans (acknowledged as debentures), and these SBICs would then make investments in small companies they imagined had prospective for advancement. Most original SBICs in the 1960s, largely concentrated on serious estate, have been commercially unsuccessful and run by people without the need of important expense encounter. In the 1970s, on the other hand, 300-500 SBICs ended up in operation, significantly far more efficiently, and in many methods outlined the undertaking cash marketplace. Cripplingly substantial curiosity charges in the 1980s, however, shown the problems of supplying very long-phrase funding making use of existing-worth debentures. That, coupled with restrictions on the maximum size of an expense (a lot more correctly, a optimum leverage which the SBA would present an SBIC) caused a decrease in the relevance of the system above the upcoming two a long time, and by 1990 there were only 180 SBICs in procedure. Over this identical time period the wider financial investment industry arrived to be outlined by massive undertaking money firms, with pension resources as a all set provide of funds to these money, alternatively than by SBICs and the SBA.

The SBA reviewed the performance of its SBICs in 1991, and in 1992 Congress handed the Compact Organization Fairness Improvement Act, completely overhauling the application and producing a new system by which the SBA could commit resources by means of SBICs, the Participating Securities Software. Instead of an unsecured financial loan, the SBA as an alternative entered a “preferred confined partnership interest” with SBICs with a confirmed amount of return. Contrary to the Debenture Plan, which essential SBICs to make periodic curiosity payments, the Participating Securities Software was produced to involve SBICs to pay the SBA a preferred return and profit share only when the SBIC realized earnings. By making it possible for an SBIC to make investments in organizations that might not however have cashflow, the SBA promoted a considerable growth of and desire in SBICs. The Act also elevated the leverage accessible to an SBIC to $90 million, letting SBICs to much better compete with venture funds corporations. For the initially time the SBA also executed a regulation framework reliable with the non-public enterprise money sector and essential SBICs to make investments a minimum level of personal funds. Despite this renewed versatility, adhering to the collapse of the “dot-com bubble” the Bush Administration made a decision that there was no want for an SBA fairness investment system and that the existing method posed way too much hazard the SBA shut the Participating Securities application in 2002.

Corporations that benefited from SBIC investment in their early phases contain Apple, Costco, Federal Categorical, Intel, Tesla, and Complete Food items.

Mechanics and Demands

Following its departure from fairness expense, the SBA currently offers leveraged funding in only a single kind, its Debenture System. For every single $1 the SBIC raises in non-public capital, the SBA will dedicate $2 of debt, up to a cap of $175 million. In this method an SBIC with $50 million in private funds available can accessibility up to $100 million in SBIC leverage, permitting them to spend $150 million in qualifying smaller businesses.

SBIC investments can be created in a wide range of methods, from “straight” financial debt with no fairness features (Financial loans), financial debt with equity characteristics (Financial debt Securities) or stock and partnership passions (Equity Securities), or any blend of the above, with the desire amount billed by the SBA dependent on the type of financial investment. Investments will have to have a term of at minimum a 12 months, but curiosity prices are priced very favorably by comparison to the sector. In 2019, for illustration, $991 million of debentures issued by 63 SBICs were priced at a 2.283 p.c fascination amount, a 46.1 foundation stage improvement on the then 10-12 months Treasury notice price of 1.822 %, and much much less than the 5 percent fascination prices banking companies usually cost when serving as lenders to modest businesses.

An SBIC can only devote in “Small Businesses” and must make investments at the very least 25 per cent of funds in “Smaller Enterprises” for each the SBA normal definitions, which range by sector. SBICs are prohibited from investing in selected sorts of little organization, most notably these applying the proceeds or with payroll or functions dependent outside of the United States (but also together with lots of genuine estate initiatives, possibly a lesson uncovered from the 1960s).

Favorable Lawful Therapy

Even though the SBA currently provides only one kind of financing, there exist two kinds of SBIC, as some SBICs do not get SBA financing at all. Regarded as non-leveraged SBICs (or often financial institution-owned SBICs) these corporations operate totally in the identical way as regular investment companies, delivering a broad assortment of debt and equity expense. What makes non-leveraged SBICs exclusive is the similar need that, to be certified by the SBA, these SBICs make investments only in qualifying compact organizations. In return these non-leveraged SBICs acquire favorable authorized remedy. SBIC investments are specifically discovered in SBA statute as “qualified investments” for Neighborhood Reinvestment Act (CRA) uses, a 1977 legislation created to advertise economical inclusion by demanding banks to give expert services to very low- and middle-profits communities. SBIC investments also acquire favorable cure when calculating a bank’s regulatory capital necessities, as underneath a certain level SBIC investments do not incur a funds demand. Eventually, SBIC investments are exempt from Dodd-Frank needs preventing banking institutions from acquiring ownership interests in private fairness companies, and SBICs are exempt from Volcker rule requirements protecting against banking institutions from investing in SBICs. These exemptions make SBICs incredibly interesting to banks needing to fulfill their regulatory, money, and investment decision prerequisites, all but guaranteeing a constant circulation of non-public capital to SBICs. Likewise, specified SBIC advisers are exempt from provisions of the 1940 Financial commitment Advisers Act that would if not demand advisers of non-public resources to sign up with the Securities and Exchange Commission (SEC).

Non-leveraged SBICs are themselves exempt from numerous of the SBA requirements that govern Debenture SBICs, most of them operational: from management-ownership range prerequisites, prohibiting a one investor from owning around 70 % of an SBIC the ability to offer belongings without SBA permission and recordkeeping requirements, outlining why some SBICs could choose to not obtain SBA funding and yet obtain the SBIC license.

Economics

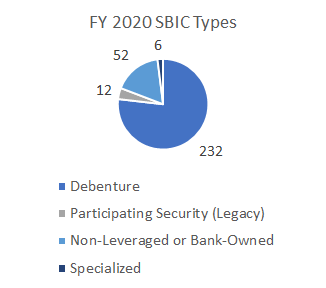

As of September 30, 2020, there were being 302 licensed SBICs holding $19 billion in personal capital and $11 billion of excellent SBA leverage. For the similar calendar year these SBICs documented $5 billion in financing to just above 1,000 modest enterprises, developing or supporting an approximated 92,000 work opportunities. Through this period the SBA licensed 26 new SBICs, 21 outfitted for Debenture financing and 5 non-leveraged, with yet another 46 SBICs in the review pipeline.

Conclusions

For in excess of 60 many years the SBA has supplied financing to hundreds of licensed investment decision companies investing in countless numbers of American tiny corporations. Though $67 billion about this period is little by comparison to the $679 billion disbursed to day by the PPP, the SBIC has several beautiful functions to take into consideration. While the SBA is prescriptive in placing out the targets for SBIC investments, and applies watchful scrutiny and oversight of its licensees, it is no far more associated than that (outdoors of the provision of funding!). Investment decision administrators with a long time of expertise, and not authorities, ascertain who to spend in, and they do so with authentic pores and skin in the video game with the necessity to entrance personal funds. Though desire rate and loan terms are particularly generous, they are however tethered to a current market fact. Specified the modest scale of the SBIC, and the extensive-expression nature of SBIC investments, it is hard to think about a purpose for the SBIC in pandemic-connected rescue attempts, and the PPP has done admirably in injecting billions into the sector in really short get. A non permanent shot of adrenaline is no substitute, on the other hand, for lengthy-expression help by specialists, and the SBIC represents 1 of the most prosperous public-private partnerships in U.S. background.