The competing forces investing blows over lowly GameStop | Business News

3 min readMoney marketplaces have been rocked this 7 days by a battle initiated by standard people today versus individuals who are normally dubbed market manipulators – hedge cash.

This is not getting fought on trading flooring but on line and is a consequence of an explosion in the recognition of novice share buying and selling by armchair buyers and collaboration among the them.

Listed here, Sky Information clarifies what has took place to rattle market place regulators, hedge fund brief-sellers and even the suppliers of the zero-commission on the internet trading platforms people are applying.

How did this come to light?

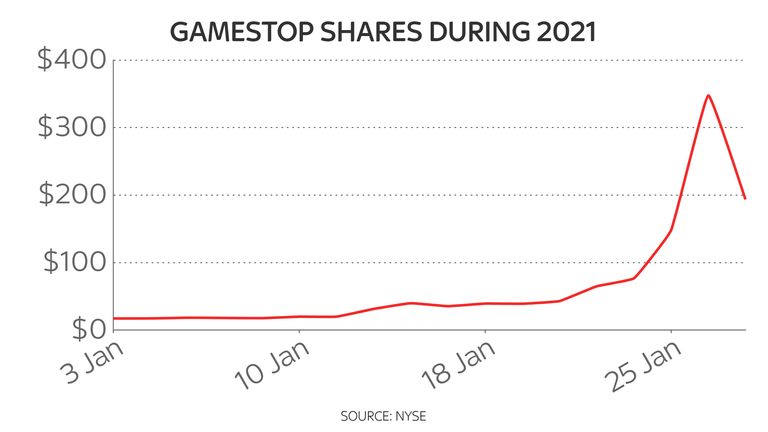

Abnormal marketplace action was very first linked to a surge in the share cost of GameStop.

The reason why is that, this is a battling US retailer that has been closing stores at tempo about the earlier handful of yrs because of weak investing and the enterprise had claimed nothing to reveal a unexpected change in its fortunes.

Shares, which experienced been buying and selling at underneath $20 a pop, have been suddenly hitting values all-around $350.

Even though it is down on before peaks, there continues to be superior volatility about its market place value.

Who was behind the value explosion?

In this article is in which the army of beginner buyers enters the phase.

The stay-at-dwelling concept demanded of people today throughout the coronavirus disaster, coupled with rock bottom fascination prices, has motivated tens of millions to request out new ways to make their income work superior for them.

It has found the likes of on the web buying and selling platforms these as Robinhood and Trading212 become immensely well-known.

What end users have been carrying out is collaborating on social media platforms, together with Reddit, to conspire versus the things to do of hedge funds by making use of traded possibilities, a products providing the holder the suitable to get an asset at a mounted value.

The surge in price has been exacerbated by automatic algorithmic trading, which can be brought on on large rate shifts to address a experienced trader’s situation.

What are hedge cash and why have they misplaced out?

These industry individuals are described as exact forecasters of stock industry returns by lecturers and market place manipulators by critics.

The companies engage in a practice recognized as small-promoting.

Short-sellers borrow shares and instantly offer them, betting the rate will fall prior to they buy back the shares and return them, pocketing the variation.

The GameStop stock was greatly shorted so when the selling price rose, the traders shed their bets and faced losses.

Does it make a difference that hedge resources have suffered so badly?

No. Until you are a hedge fund manager.

The worry listed here among the regulators is irregular working of marketplaces, generally based on info, turning into a danger to economical methods via disinformation and muddied motives of social media chatroom users.

The wallstreetbets board on Reddit by yourself has over four million users.

What are the other implications?

The activism is obviously spreading.

When dozens of other closely-shorted stocks have been specific there are plainly elements of the activist community intent on bringing down hedge cash – with loss of life threats even claimed.

On the other hand, commentators and notable US politicians, together with Republican senator Ted Cruz, are suggesting that a lot of are just taking part in Wall Road at its own activity.

Mr Cruz accused Robinhood of retaining out the “very little guy” when it implemented a investing freeze.

How are the buying and selling platforms now suffering?

The likes of Robinhood could have benefited from surging purchaser numbers by the working day but the trading frenzy has created its personal complications.

Lots of, these as Trading212 on Thursday, have had to suspend new customer programs and quit consumers buying far more shares in corporations including GameStop to the fury of traders.

Platform outages have been widespread and the New York Periods documented on Friday that Robinhood had had to elevate more than $1bn in unexpected emergency funding to reduce even more boundaries on consumer trades.

In short, they are a victim of their possess attractiveness.