S&P 4K, Dakota Pipeline, Fed’s Powell and AMD-Xilinx top week ahead

4 min readMJP Wealth Advisors President Brian Vendig and Indeed chief economist Jed Kolko provide insight into the March jobs report, the struggling restaurant industry, and the best way to invest in today’s markets.

When investors return from the long Easter holiday weekend, they’ll be greeted with a U.S. stock market at record highs.

The S&P 500 crossed the 4,000 level last week for the first time in history with the 1,000 point milestone now the fastest on record.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| SP500 | S&P 500 | 4019.87 | +46.98 | +1.18% |

Key economic reports throughout the first half of the week, as well as the minutes of the Federal Reserve’s FOMC meeting for February and an appearance by Fed Chair Jerome Powell, will be in focus. Along with an important decision on Dakota Access Pipeline.

FOX Business takes a look at the upcoming events that are likely to move financial markets in the coming days.

US ECONOMY ADDS 916,000 JOBS IN MARCH AS SERVICE-SECTOR HIRING BOOMS

Monday 4/5

The Institute of Supply Management will release its index of service sector activity for the month of March. In February, service activity dropped to a reading of 55.5 as the United States faced hurdles on growth related to the pandemic. Despite the decline, February’s index marked the ninth straight month of growth in the services sector. The survey’s measure of prices paid by services industries jumped to 71.8 last month, the highest reading since September 2008, compared to 64.2 in January.

The Commerce Department will also release its report on factory orders for the month of February. U.S. factory orders rose 2.6% in January to $509.4 billion, the ninth consecutive month of gains. New orders for manufactured durable goods in January increased 3.4% to $256.7 billion while new orders for manufactured non-durable goods increased 1.9% to $252.7 billion.

Tuesday 4/6

On Tuesday, the Labor Department will release job openings for the month of February also known as JOLTS. Job openings in January came in at 6.9 million. The number of hires were little changed at 5.3 million while separations decreased to 5.3 million.

The International Monetary Fund will also publish its upgraded forecast for global economic growth. According to the IMF’s World Economic Outlook update in January, the global economy is currently projected to grow 5.5% in 2021 and 4.2% in 2022.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Wednesday 4/7

On Wednesday, the Federal Reserve will release the minutes from its March meeting when it said it will hold interest rates steady and indicated no major rate hikes until 2023.

Reports on consumer credit and the U.S. trade deficit are also due.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| AMD | ADVANCED MICRO DEVICES, INC. | 81.09 | +2.59 | +3.30% |

| XLNX | XILINX, INC. | 129.85 | +5.95 | +4.80% |

Advanced Micro Devices and Xilinx will be in focus as shareholders from both companies vote on AMD’s proposed acquisition.

Under the terms of the $35 billion agreement, Xilinx shareholders will receive 1.7234 AMD shares for each Xilinx share they own. AMD shareholders will own approximately 74% of the combined company while Xilinx shareholders will control the remaining approximately 26%.

The acquisition will bolster AMD’s presence in the burgeoning data center chip market, making it a more formidable foe to rival Intel and may spark more industry consolidation.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| INTC | INTEL CORP. | 64.55 | +0.55 | +0.86% |

CLICK HERE TO READ MORE ON FOX BUSINESS

Thursday 4/8

On Thursday, the Labor Department will release its weekly initial and continuing jobless claims. The agency’s latest data showed the number of Americans filing first-time jobless claims unexpectedly rose to 719,000 for the week ending March 27, while continuing claims rose to 3.794 million for the week ending March 20.

Fed Chair Jerome Powell will also participate in the IMF’s Debate on the Global Economy seminar starting around 12 PM ET.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| STZ | CONSTELLATION BRANDS INC. | 229.62 | +1.62 | +0.71% |

| LEVI | LEVI STRAUSS & CO. | 23.69 | -0.22 | -0.92% |

On the earnings docket, Constellation Brands, maker of Robert Mondavi wines and Corona beer will report earnings in the morning, while Levi is expected to report results after the close of trading

Friday 4/9

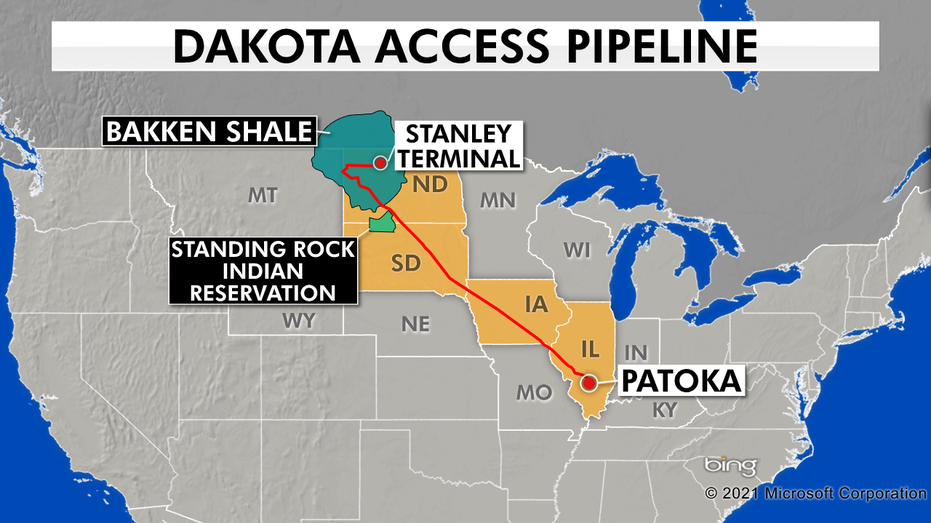

On Friday, the Biden administration will decide the fate of the Dakota Access Pipeline. In February, the federal government asked a court to postpone a conference on the status of the pipeline while new officials are brought up to speed on the case.

The Dakota Access Pipeline transports 570,000 barrels of oil each day from the Bakken Shale in North Dakota through South Dakota, Iowa, and to an oil terminal in Illinois. It is the safest and most efficient way to transport the oil, according to operator Energy Transfer Partners.

As for economic data, the Labor Department will release its producer price index for the month of March and the Commerce Department will release wholesale inventories for the month of February.

In February, the producer price index for final demand rose 2.8% year-over-year, marking the largest annual increase since October 2018. Prices edged up 0.5% month over month, slowing from the 1.3% increase in January. Meanwhile, wholesale inventories rose 1.3% month-over-month in January and total inventories rose 0.6% year-over-year. Sales at wholesalers jumped 4.9% to $531.7 billion. At January’s sales pace it would take wholesalers 1.24 months to clear shelves, the shortest period since November 2014.