Skyline Champion (NYSE:SKY) Is Searching To Go on Expanding Its Returns On Money

3 min readIf we want to discover a inventory that could multiply above the lengthy expression, what are the fundamental trends we ought to seem for? First of all, we would want to determine a growing return on capital used (ROCE) and then together with that, an at any time-escalating foundation of cash employed. This shows us that it is a compounding device, able to continuously reinvest its earnings back again into the business enterprise and crank out larger returns. So when we seemed at Skyline Winner (NYSE:SKY) and its development of ROCE, we actually appreciated what we observed.

Knowledge Return On Funds Employed (ROCE)

Just to make clear if you are not sure, ROCE is a metric for assessing how a great deal pre-tax earnings (in share terms) a organization earns on the money invested in its company. The formulation for this calculation on Skyline Winner is:

Return on Money Utilized = Earnings Ahead of Fascination and Tax (EBIT) ÷ (Overall Property – Latest Liabilities)

.17 = US$109m ÷ (US$918m – US$264m) (Centered on the trailing twelve months to April 2021).

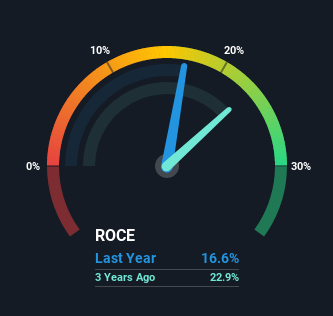

Therefore, Skyline Champion has an ROCE of 17%. In absolute conditions, that’s a really usual return, and it is really rather close to the Consumer Durables business regular of 14%.

See our newest investigation for Skyline Champion

In the higher than chart we have calculated Skyline Champion’s prior ROCE against its prior effectiveness, but the long run is arguably more significant. If you are intrigued, you can view the analysts predictions in our free report on analyst forecasts for the firm.

What The Development Of ROCE Can Convey to Us

The traits we’ve noticed at Skyline Champion are very reassuring. The facts exhibits that returns on cash have increased substantially over the final 5 a long time to 17%. Basically the business enterprise is earning more per dollar of capital invested and in addition to that, 328% much more money is remaining employed now also. So we are really substantially inspired by what we’re observing at Skyline Winner thanks to its capacity to profitably reinvest money.

A person much more matter to observe, Skyline Champion has reduced existing liabilities to 29% of whole assets above this period, which properly minimizes the amount of funding from suppliers or brief-phrase collectors. For that reason we can rest assured that the expansion in ROCE is a end result of the business’ basic advancements, alternatively than a cooking class featuring this company’s guides.

What We Can Learn From Skyline Champion’s ROCE

All in all, it is really great to see that Skyline Winner is reaping the rewards from prior investments and is rising its cash base. And with a respectable 60% awarded to people who held the stock over the past a few a long time, you could argue that these developments are setting up to get the attention they ought to have. As a result, we consider it would be well worth your time to check out if these developments are heading to continue.

On a different take note, we’ve located 2 warning indications for Skyline Winner you may possibly want to know about.

For those people who like to commit in reliable firms, test out this no cost checklist of corporations with stable harmony sheets and significant returns on equity.

Promoted

If you come to a decision to trade Skyline Champion, use the cheapest-value* system that is rated #1 In general by Barron’s, Interactive Brokers. Trade stocks, solutions, futures, forex, bonds and money on 135 marketplaces, all from a solitary integrated account.

This write-up by Only Wall St is standard in mother nature. It does not constitute a recommendation to purchase or offer any stock, and does not consider account of your goals, or your fiscal predicament. We aim to deliver you extensive-time period focused analysis pushed by fundamental knowledge. Note that our investigation could not component in the latest selling price-sensitive company announcements or qualitative substance. Basically Wall St has no placement in any shares stated.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Yearly On the web Overview 2020

Have suggestions on this report? Concerned about the content material? Get in contact with us instantly. Alternatively, e mail editorial-workforce (at) simplywallst.com.