Skyline Champion (NYSE:SKY) Could Conveniently Consider On Far more Personal debt

5 min readLegendary fund manager Li Lu (who Charlie Munger backed) when stated, ‘The most significant investment decision danger is not the volatility of rates, but whether or not you will endure a lasting reduction of money.’ It truly is only organic to contemplate a firm’s balance sheet when you analyze how risky it is, considering the fact that credit card debt is typically concerned when a organization collapses. We can see that Skyline Champion Corporation (NYSE:SKY) does use financial debt in its small business. But is this financial debt a problem to shareholders?

Why Does Debt Provide Danger?

Personal debt and other liabilities grow to be risky for a business enterprise when it can’t simply fulfill all those obligations, possibly with cost-free funds move or by boosting funds at an desirable selling price. In the long run, if the enterprise can’t satisfy its legal obligations to repay personal debt, shareholders could walk away with almost nothing. Even though that is not far too prevalent, we generally do see indebted businesses forever diluting shareholders simply because loan companies force them to raise capital at a distressed price. Of course, loads of businesses use credit card debt to fund progress, with out any detrimental penalties. When we think about a company’s use of debt, we first appear at dollars and credit card debt jointly.

See our most recent investigation for Skyline Winner

What Is Skyline Champion’s Web Financial debt?

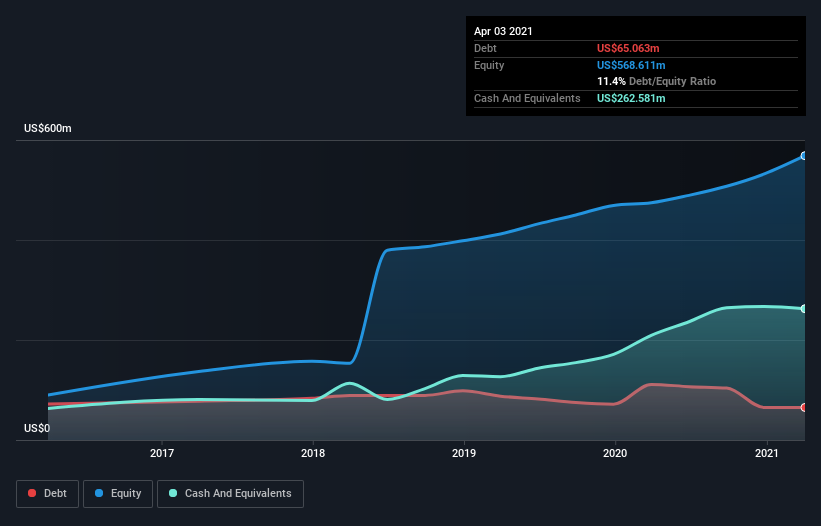

The graphic underneath, which you can click on on for greater element, shows that Skyline Champion had financial debt of US$65.1m at the close of April 2021, a reduction from US$111.2m about a year. Nonetheless, its stability sheet reveals it holds US$262.6m in cash, so it in fact has US$197.5m internet hard cash.

How Sturdy Is Skyline Champion’s Stability Sheet?

The most up-to-date equilibrium sheet facts demonstrates that Skyline Champion had liabilities of US$263.6m due in just a 12 months, and liabilities of US$85.6m falling because of just after that. On the other hand, it had income of US$262.6m and US$57.5m worthy of of receivables thanks in a year. So its liabilities outweigh the sum of its money and (in the vicinity of-phrase) receivables by US$29.2m.

Possessing regard to Skyline Champion’s size, it appears that its liquid property are very well balanced with its complete liabilities. So while it is hard to think about that the US$3.19b corporation is having difficulties for dollars, we nevertheless believe it is really worthy of checking its balance sheet. Though it does have liabilities truly worth noting, Skyline Champion also has far more hard cash than financial debt, so we’re very confident it can control its personal debt properly.

Also excellent is that Skyline Winner grew its EBIT at 19% more than the last 12 months, even more raising its means to deal with personal debt. The equilibrium sheet is obviously the spot to focus on when you are analysing debt. But finally the potential profitability of the business enterprise will determine if Skyline Winner can strengthen its harmony sheet above time. So if you might be focused on the foreseeable future you can verify out this cost-free report showing analyst revenue forecasts.

Finally, a business can only spend off financial debt with chilly hard funds, not accounting earnings. Skyline Champion may possibly have internet cash on the balance sheet, but it is even now appealing to glance at how properly the organization converts its earnings just before fascination and tax (EBIT) to totally free funds stream, mainly because that will affect each its need for, and its potential to handle personal debt. Over the very last two a long time, Skyline Champion really created additional free income circulation than EBIT. You will find almost nothing far better than incoming dollars when it comes to keeping in your lenders’ very good graces.

Summing up

Whilst it is normally practical to search at a firm’s overall liabilities, it is extremely reassuring that Skyline Winner has US$197.5m in internet income. And it impressed us with no cost cash stream of US$146m, currently being 104% of its EBIT. So we don’t think Skyline Champion’s use of personal debt is risky. The balance sheet is evidently the space to aim on when you are analysing debt. But eventually, each individual organization can include hazards that exist outdoors of the harmony sheet. These risks can be tough to location. Each and every company has them, and we have noticed 1 warning signal for Skyline Champion you ought to know about.

At the conclude of the working day, it can be normally better to concentrate on firms that are absolutely free from internet debt. You can obtain our specific checklist of this sort of firms (all with a track history of revenue development). It is totally free.

Promoted

When investing Skyline Champion or any other expenditure, use the system considered by a lot of to be the Professional’s Gateway to the Worlds Sector, Interactive Brokers. You get the least expensive-price tag* investing on stocks, alternatives, futures, forex trading, bonds and funds all over the world from a one integrated account.

This post by Only Wall St is typical in character. It does not represent a suggestion to obtain or market any inventory, and does not just take account of your objectives, or your financial condition. We aim to carry you long-expression concentrated investigation pushed by basic data. Notice that our investigation may not aspect in the hottest rate-sensitive company bulletins or qualitative materials. Only Wall St has no situation in any shares described.

*Interactive Brokers Rated Lowest Charge Broker by StockBrokers.com Yearly On the net Review 2020

Have suggestions on this write-up? Concerned about the content? Get in contact with us immediately. Alternatively, e mail editorial-group (at) simplywallst.com.