Rishi Sunak ‘considering Amazon tax’ to claw back again pandemic borrowing from on the internet vendors who profited | Politics Information

3 min readAmazon and other main world wide web merchants could be hit with a new online product sales tax to enable the United kingdom pay its money owed after comprehensive borrowing all through the pandemic.

Treasury sources confirmed Chancellor Rishi Sunak is thinking of concentrating on providers that have done properly out of the pandemic to help fork out back British isles federal government debts constructed up supporting industries by the COVID-19 disaster.

The new tax is becoming thought of as component of a business fees evaluate after a consultation was held last calendar year.

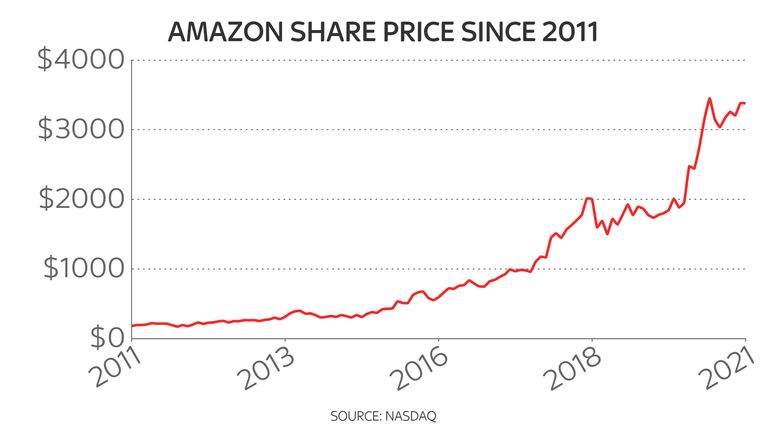

Amazon sales in the United kingdom improved by 51% to just about £20bn in 2020, as lockdown limits pressured folks to invest in online.

ASOS, the online garments retailer, and foods shipping and delivery firms these types of as Deliveroo also benefited, with gains spiking through the several lockdowns about the previous 12 months.

Leaked e-mail showed Treasury officials had summoned tech corporations and retailers to a meeting this thirty day period to explore the on line product sales tax, the Sunday Moments documented.

The paper reported Downing Street is also seeking at introducing an “abnormal revenue tax” on companies that have found profits surge because of to COVID-19, that means a double strike for Amazon.

A Treasury spokesman mentioned: “We want to see flourishing large streets, which is why we’ve used tens of billions of pounds supporting outlets throughout the pandemic and are supporting city centres as a result of the modifications on line searching brings.

“Our enterprise premiums review simply call for proof integrated inquiries on whether we really should change the stability concerning on-line and physical stores by introducing an on the web sales tax. We’re thinking about responses now.”

Mr Sunak is not anticipated to propose the tax at his 3 March finances and will rather look at extending furlough and the enterprise premiums getaway.

In spite of Amazon’s approximately £20bn profit for 2020 it only experienced a tax turnover ratio of .37%, in accordance to true estate adviser Altus Group.

Altus looked at Amazon’s overall British isles estate, including workplaces, warehouses and selection lockers, and located its over-all business rates liabilities were approximated to be close to £71.5m at the start off of the 2020/21 economic 12 months.

Superior avenue merchants compensated all around 2.3% of annual retail product sales in company rates just before the pandemic, the Centre for Retail Exploration stated.

TechUK, the UK’s technology trade affiliation, informed Sky News it had not gained a ask for from Treasury officials for a conference this month.

“We would, nonetheless, welcome the prospect to explore the overall threats and positive aspects of such a tax, the results on company or the wider consumer and financial impacts,” a spokesman explained.

“Tech firms have played a essential purpose in holding the financial system jogging about the previous year and will be necessary to potential economic growth and restoration.”

Helen Dickenson, main govt of the British Retail Consortium, explained ministers need to not prevent businesses’ means to get well from the pandemic.

“The essential to reviving our significant streets is fundamental reform of the enterprise charges technique and we oppose any new taxes that boost the expense stress on the market which is presently much too large,” she stated.

“Economic restoration after COVID will be run by customer demand – the chancellor ought to guarantee he will not introduce any new taxes that stifle this.”

Amazon explained it would not remark on the on the internet profits tax reviews.

A spokesman stated: “Past 12 months we produced 10,000 new positions and past week we declared 1,000 new apprenticeships.

“This ongoing investment assisted contribute to a full tax contribution of £1.1 billion throughout 2019 – £293 million in immediate taxes and £854 million in oblique taxes.”