Reddit forum’s part in Gamestop shares frenzy faces regulatory probe | Business enterprise Information

US regulators are to review remarkable rallies in the shares of struggling gaming retailer Gamestop, portion-pushed by participants of an trader discussion board on Reddit, as fears grow in excess of a surge in clear trader activism.

The Securities and Exchange Fee mentioned it was performing with fellow regulators to “evaluate the situation and evaluation the pursuits of controlled entities, financial intermediaries, and other market place participants”.

The action reflects deep and widespread problem over the working of money markets, with the trading activity spreading globally like to the United kingdom.

It all begun with Gamestop. It is a US gaming retailer that has been closing shops at a pace in modern several years for the reason that of weak income.

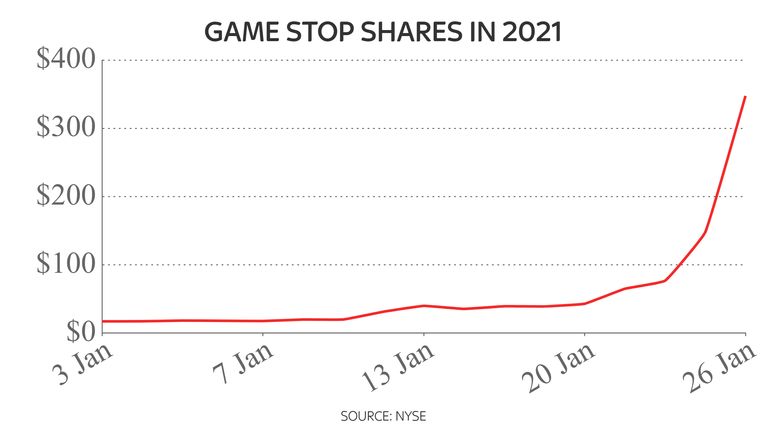

But its shares were up by 1,744% in the 12 months to date – with a industry price above $20bn – at the close of investing on Wednesday night time.

The price increase of the past 7 days has designed additional than $2bn in particular prosperity for its three largest particular person shareholders, whose holdings have not elevated through the frenzy.

The staggering leap represents a victory for retail buyers above hedge fund short-sellers, who are nursing significant losses, as markets witness a increase in beginner stock investing.

Millions of common people have taken benefit of zero-commission buying and selling platforms for the duration of the coronavirus disaster – often working with social media community forums to explore opportunities.

By piling in to a stock together, in a co-ordinated way, they have established worth for them selves towards sector norms.

The benefit surge has not been limited to Gamestop but the risks of this sort of activity grew to become obvious past night time.

Gamestop shares, and those of other companies which include BlackBerry and AMC Enjoyment, fell by additional than 20% in extended trading when it emerged that Reddit had briefly closed the Wallstreetbets chat place.

Discussion within it is commonly noticed by market place analysts as the catalyst for the activism.

It is understood to have in excess of four million members.

The market place conduct has prompted common phone calls for scrutiny of buying and selling fuelled by nameless social media posts. Reddit reported it experienced not been contacted by any authorities in relation to users’ behaviour.

Some seriously-shorted United kingdom stocks, such as Cineworld, have also confirmed signals of retail activist-type gains. Sky News has approached the Money Carry out Authority for a reaction.

Customers of London-based investor platform Buying and selling212 complained by using its Twitter account on Thursday that they experienced been blocked from shopping for Gamestop shares, with an unconfirmed report suggesting their positions could only be closed.

In a indication of the rush for trading accounts between customers of the public, Investing212 claimed: “Due to the unparalleled need, we have quickly stopped onboarding new purchasers. When we approach the current queue, we will be open for new registrations.”

Broader US current market falls in new times have been blamed on hedge funds promoting positions to pay for losses shorting Gamestop.

Wednesday’s session noticed the main indexes on Wall St eliminate more than 2% and futures suggest more turbulence forward.

Even the new US treasury secretary, Janet Yellen, claimed she was “checking the predicament” though a point out regulator has called for Gamestop shares to be suspended for 30 times to allow for a cooling off time period.

Technological know-how trader Chamath Palihapitiya explained to Sky’s sister channel CNBC: “We are transferring to a globe wherever regular folk have the exact same obtain as professionals and can arrive to the exact same summary or maybe the reverse.

“The remedy is additional transparency on the institutional side, not a lot less entry for retail.”

In Gamestop’s scenario, it has been shuttering merchants for many years in a hard retail landscape and market place analysts have likened the inventory interest – driven purely by retail traders – to a pyramid scheme.

Nasdaq main Adena Friedman said: “If we see a considerable rise in the chatter on social media … and we also match that up against abnormal trading action, we will probably halt that stock to allow for ourselves to investigate the condition.”