Rate of inflation more than doubles in just 1 month to 1.5% | Business News

3 min readThe rate of inflation a lot more than doubled in just just one month to 1.5% all through April, posing a rate increase challenge to the Bank of England amid the fragile economic restoration from the coronavirus crisis.

The Place of work for Nationwide Figures (ONS) mentioned the client selling prices index (CPI) measure rose from .7% in March, marking the most significant month-on-thirty day period spike in over a ten years.

The increase was pushed, the report reported, by soaring family utility, garments, and motor gas rates.

Inflation is surging in western economies following above a calendar year of COVID-19 disruption.

The CPI evaluate stood at just .2% in February.

Economic marketplaces have taken fright in modern months over fears crisis period central bank support will be little by little withdrawn, by curiosity premiums being elevated from rock base degrees, to counter the rate of value will increase.

But custodians of central financial institutions, together with these in the US and the governor of the Lender of England, have signalled that they see the inflationary photograph getting dominated by “transitory” – not lasting – value movements.

:: Pay attention and subscribe to The Ian King Business podcast listed here.

Alternatively, they see costs currently being distorted only by life acquiring back again into equipment even though, in the scenario of the US, federal stimulus which includes cheques for households and significant federal government investment have fuelled an inflation increase with its CPI price managing at 4.2%.

Lender of England main Andrew Bailey informed a committee of peers on Tuesday that there is no robust proof yet that rises in charges paid out by makers are feeding via into Uk client prices.

Any hike in interests prices, aimed at countering rate increase actions, would make borrowing much more high priced and danger choking off financial growth at a time when the state is recovering from its worst once-a-year slump in extra than 300 many years.

At an annual price of 1.5% the CPI measure is nearing the Lender of England’s target of 2% and economists forecast it will smash past that when the up coming update is delivered in a month’s time as charges for air journey, domestic lodging and offer holidays leap in response to rebounding purchaser demand.

ONS chief economist, Grant Fitzner, claimed of the recent picture: “Inflation rose in April, mainly due to charges climbing this 12 months as opposed with the falls seen at the commence of the pandemic this time last year.

“This was found most clearly in home utility charges and outfits price ranges.

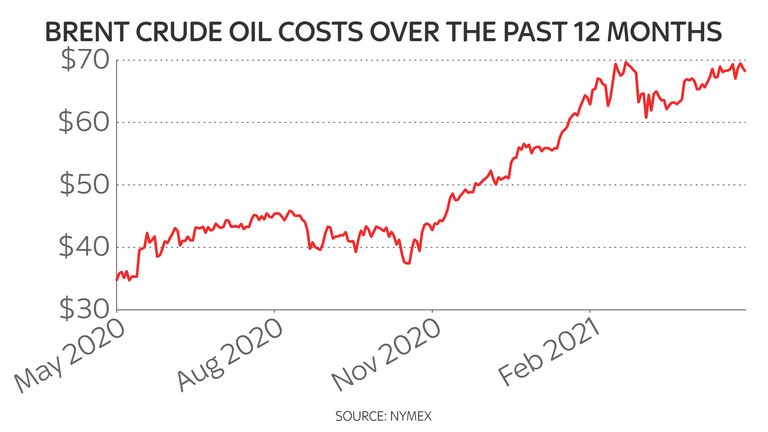

“As the value of crude oil continues to increase, this has fed by way of to the price of motor fuels, which are now at their greatest given that January 2020.”

The ONS information showed motor gasoline inflation soaring at its quickest speed for additional than four many years.

A £96 enhance in the so-referred to as default tariff value cap through April contributed to the increase whilst apparel shops also elevated their selling prices very last month as non-necessary retail reopened.

Mr Bailey reported earlier this thirty day period that even though the Lender sees inflation increasing to 2.4% by the year’s conclude, pushed mostly by vitality charges, it is expected to tumble again under the 2% focus on shortly after as selling price improves unwind.

Howard Archer, British isles economist with forecaster EY Product Club, mentioned: “With inflation set to pick up more over the coming months and the economic climate looking poised for good recovery from the next quarter, interest is significantly focusing on when the Lender of England could get started to tighten financial coverage fairly than will the Financial institution give further stimulus.

“Having said that the Lender of England did not look to be in a hurry to tighten plan in the minutes of the May perhaps MPC [monetary policy committee] meeting.”