Prospect of bidding war for Morrisons drives share selling price surge | Enterprise News

3 min readShares in Morrisons surged by a lot more than 11% at Monday’s current market open as buyers licked their lips at the prospect of a bidding war for the UK’s fourth premier supermarket chain.

There is speculation of curiosity from Amazon and personal equity firms after it was introduced on Saturday that the FTSE 100 firm had agreed a takeover led by SoftBank-owned Fortress Expense Team.

The deal, which included commitments to the latest administration staff, tactic and its £10 for each hour shop ground wage, valued Morrisons at £6.3bn by means of a bid of 254p-for each-share.

Morrisons shares were trading at up to 267p-for every-share in early discounts.

The Fortress-led bid topped a rival £5.5bn provide from US personal equity agency Clayton, Dubilier & Rice (CD&R) two months previously.

The encouraged present by the consortium, which also involves Canada Pension System Expenditure Board and Koch True Estate Investments, is unlikely to be the ultimate bid on the desk.

CD&R could still appear back with a new supply – and it has until finally 17 July to do so beneath Town takeover policies.

Private fairness rival Apollo World wide Administration unveiled on Monday morning that it was in “the preliminary phases of assessing a achievable offer you for Morrisons”.

Its statement added: “No solution has been made to the board of Morrisons.

“There can be no certainty that any offer you will be designed, nor as to the phrases on which any such provide might be manufactured.”

Industry analysts expect Amazon, which has an present grocery delivery partnership with Morrisons and a fledgling Amazon Clean keep providing of its individual, could be among the intrigued events.

Morrisons has 497 stores across the Uk and employs 110,000 persons.

It is appealing simply because supermarket chains are cash generative and mostly personal the residence they run from.

Fortress, which bought Majestic Wine in 2019, has pledged to be a “excellent steward” of Morrisons, if its consortium wins shareholder backing, with no “content” sale and leaseback property bargains prepared.

The Unite union claimed it was searching for “unbreakable assures” for staff from the administration workforce to make certain they did not reduce out if a takeover proceeded.

It pointed to the prospect of a “bonanza” payout for chief govt David Potts and his top staff beneath the terms of the Fortress settlement.

It would see Mr Potts make £9.2m by providing his present shares alone – not accounting for present-day bonuses – while chief functioning officer Trevor Pressure would pocket £3.6m.

The prospect of a Morrisons takeover comes scorching on the heels of Walmart’s sale of Asda to the Issa brothers and TDR funds past 12 months for £6.8bn.

Shares in listed grocery rivals Tesco, Sainsbury’s and M&S were being all about 1% up as the wider sector arrived below likely bid scrutiny.

Town commentator David Buik, of Aquis Trade, said the WM Morrison offer raised a lot of concerns.

He wrote: “Is this the suitable price? Is this action the start of asset stripping, with Morrison owning so substantially residence?

“Will this get started a bidding war? Will… Amazon quickly appear from ‘left-field’?

“Could Sainsbury’s quickly be in participate in as an additional target for hungry predators?

“Morrison may look like ‘a snip’ to get cheaply into (the) Uk food stuff marketplace.

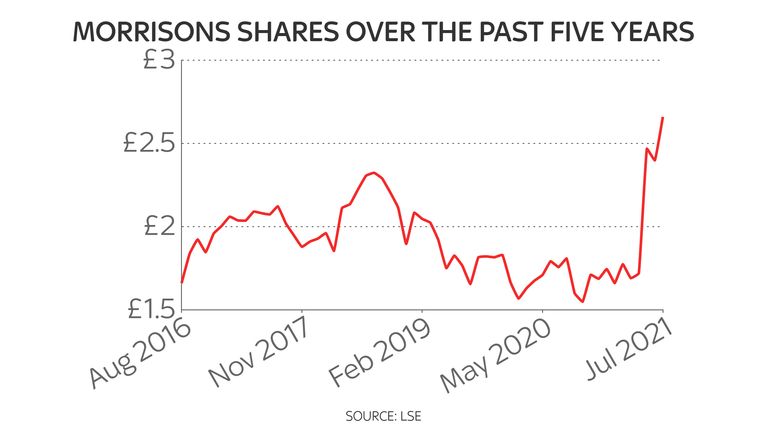

“The shares have long gone nowhere in the past five several years. Final 12 months Morrison posted a gain of £201m on income of £17.6bn.”