Opinion: Really should you invest in Nio inventory? The business could be light-weight on income, but it is major on momentum

6 min readMarketWatch visitors frequently look for for news on Chinese electric car or truck upstart Nio Inc. — and for good cause. The dynamic firm has been unstable in the final 12 months or so, and each working day seems to convey a new set of headlines that have opportunity to go the inventory.

This quarterly evaluation of Nio

NIO,

inventory aims to look past the latest headlines. We will display comparisons of key metrics to view and a summary of the company’s most vital troubles to support investors make superior choices.

These updates will also consist of comparisons of results to competition. Preserve in thoughts that no two providers are alike — even rivals really do not contend in just about every area. Any investor needs to do their personal study to make informed extended-time period choices.

Where Nio suits in

It’s simple that Nio is pink hot recently, with a share value that has surged to pretty much $40 from $3 in early 2020. Even so, share price tag is only one particular reflection of a company’s overall health.

When you search at the landscape of the most greatly traded automaker stocks correct now, which includes conventional suppliers these as Normal Motors Co.

GM,

and the EV icon Tesla Inc.

TSLA,

Nio is decidedly smaller sized as an precise company. Nevertheless its nearly $70 billion in marketplace benefit places its inventory on par with legacy providers like GM, stability-sheet studies exhibit the two businesses are not even shut.

This is the fundamental challenge for investors attempting to value Nio’s shares. Do you spot your emphasis on metrics this kind of as income, manufacturing belongings and overall motor vehicles sold? Or are you betting on the long term condition of this dynamic corporation relatively than cold stats from very last quarter that might presently be out of date?

Critical metrics

Development is important for Nio buyers, and it’s plain that the company is viewing an outstanding growth. Which is significantly true around the past 12 months in what was usually a rather hostile environment for auto gross sales.

Initial, let’s look at operational metrics in advance of we get to the a great deal-followed growth level in cars bought to illustrate how significantly scaled-down Nio is than legacy automakers that may possibly be similarly valued by sector cap.

Belongings and cash

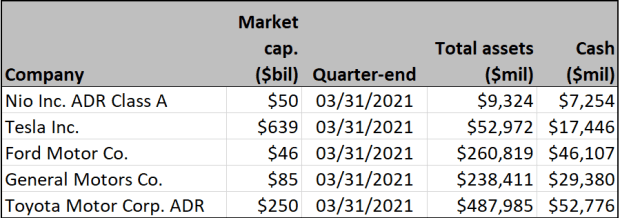

Consider that GM had $238 billion in property at the finish of 2020. Nio didn’t even have $10 billion! What’s additional, lest you believe this is all attributed to its substantial manufacturing amenities, more than $29 billion of GM’s assets were being chilly, difficult funds.

(FactSet)

Profits growth

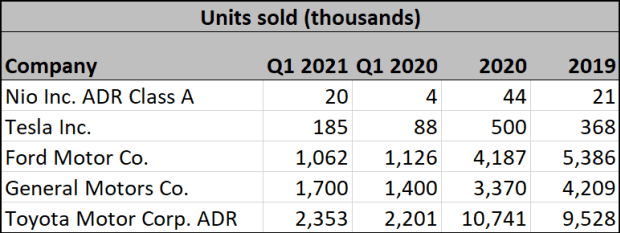

Likewise, the quantities of automobiles Nio has been marketing haven’t even been near to those people of much larger rivals. The organization bought just under 44,000 cars very last yr. That compares with nearly 3.4 million cars sold for GM and 10.7 million for Toyota Motor Corp.

TM,

throughout all its models.

(Organization filings)

Of system, this lessen base implies far more opportunity to many investors instead than a purpose to be frightened absent from Nio’s stock. Throughout the to start with quarter, Nio bought 5 situations as a lot of vehicles as it did in the exact same time period a year previously. That development charge blows the doors off everyone, even Tesla.

And just as the full variety of motor vehicles elevated considerably, so in a natural way did Nio’s prime line. But as we will see, that uptick in income has however to translate to considerable income.

Pricing energy and profitability

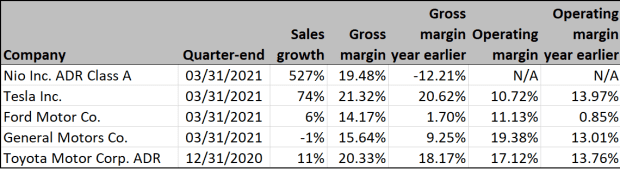

The speedy enlargement of car revenue obviously has resulted in soaring revenue. Having said that, the Chinese EV upstart proceeds to run at a loss.

Gross margins have admittedly enhanced, but gain forecasts for fiscal 2022 are continue to damaging for Nio. And extra importantly, when you search at peers including legacy automakers, it does not seem real looking that Nio could see outsized improvement from its present-day gross margins that are in-line with the relaxation of the market. That suggests as it proceeds to make investments closely in upcoming growth, traders may have to make their peace with the truth that the firm is buying and selling recent revenue probable for that vision.

(FactSet)

Free of charge hard cash circulation

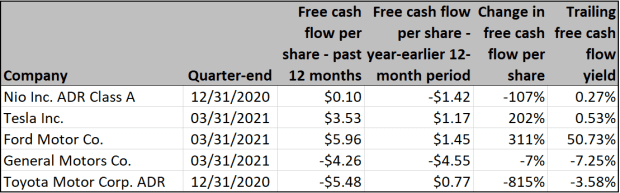

Totally free hard cash movement is a further location in which Nio has a bit of work to do, particularly if it would like to gain in excess of investors who treatment about this metric, which measures how much dollars is on hand at a business after it pays the costs for frequent functions. Primarily based on the final 12 months, free of charge dollars circulation has firmed up but is still hardly out of the crimson.

On the other hand, as a lesser organization that is scaling up promptly, it is acceptable to anticipate this kind of gap between Nio and its a lot more experienced friends as it will come into its personal. By contrast, recognized firms like GM and Toyota that observed major cash circulation issues in excess of the very last calendar year do not have the exact excuse. Fairly, these automakers feel to be burdened by structural issues — which include the precise costs related with scaling up EV functions to evolve and meet up with the issues and possibilities of a contemporary car market.

(FactSet)

Inventory valuation and effectiveness

As you have no question established on your very own, there are truly two distinct approaches to benefit momentum stocks these kinds of as Nio. One particular will involve a reliance on traditional metrics like revenue and profitability, while the other is a additional aspirational appear at where by the enterprise could be headed in the potential.

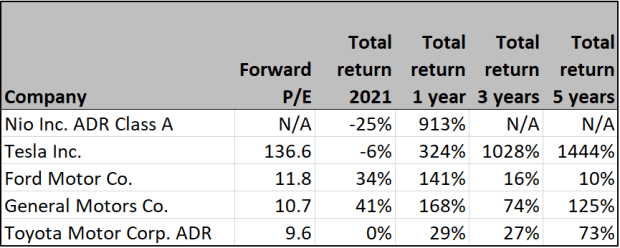

From a standard viewpoint, Nio is worrisome because it has no earnings to speak of. It’s also not precisely a warm stock lately, as shares have drawn back in the latest months and are damaging for the calendar year so far. On the other hand, the shares have gains of much more than 900% in the previous 12 months.

In reality, for those people who contact Nio “the following Tesla,” it’s not an solely unreasonable comparison — and considering Tesla’s three-calendar year and five-year returns inspite of only not too long ago moving into profitability, that could be music to investors’ ears.

(FactSet)

Wall Street’s belief

The million-dollar problem is whether Nio can keep up the two its growth developments and its extensive-term attractiveness to buyers who are not anxious with in close proximity to-phrase figures. Dependent on its most recent figures, that pattern could nonetheless be intact — but it is far from sure.

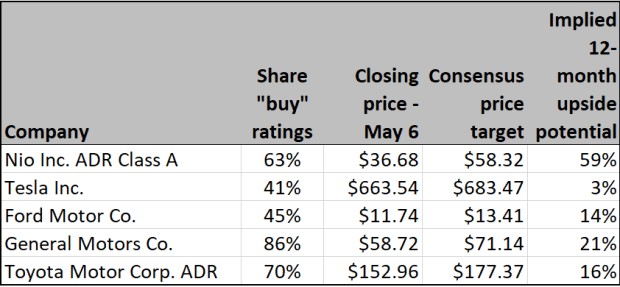

Analysts are not exactly bearish on Nio, with 63% of Wall Street professionals rating the stock a acquire and the implied 12-month upside on shares a juicy 59% centered on consensus selling price targets.

Even so, it is exciting to see that legacy automakers as a team are generally considered of better, with much more “buy” ratings even if the upside is not as remarkable. Excluding Ford Motor Co.

F,

both equally GM and Toyota have far better assistance amid the analyst community.

(FactSet)

The query for Nio buyers is very simple: Do you want to lender on the significantly less dynamic but additional set up automakers, or do you want to get on a lot more chance in this Chinese upstart in pursuit of even bigger potential gains?

With reporting by Philip van Doorn.