Oil rates tumble just after OPEC producers terminate assembly around supply dispute | Company News

2 min readOil rates have taken a tumble soon after OPEC producers unsuccessful to agree a provide enhance.

Brent crude fell $2.63 (3.4%) a barrel to $74.53, having hit a session peak of $77.84, its optimum because October 2018.

West Texas Intermediate crude futures ended up down $1.79 (2.4%) to $73.37 immediately after touching $76.98 previously – its greatest considering that November 2014.

On Monday, ministers from OPEC+ (the Corporation of the Petroleum Exporting Countries and other producers this kind of as Russia) walked absent from talks right after failing to resolve a dispute between the premier producer Saudi Arabia and the United Arab Emirates.

The United Arab Emirates had turned down a proposed 8-thirty day period extension to output curbs that OPEC+ had imposed on each other past yr.

The curbs amounted to document output cuts of practically 10 million barrels per day (bpd) – about 10% of earth output.

But the UAE needs to pump a lot more oil and states its baseline was established as well reduced when OPEC+ at first forged its manufacturing pact.

The fall in oil rates was attributed to fears that the UAE would step in and include barrels, forcing the other international locations to observe and boost source.

Some OPEC+ resources explained to Reuters information company they even now anticipated the team to resume talks later this thirty day period, but a day has not been formally verified.

Goldman Sachs has claimed the collapse of the talks introduced uncertainty to OPEC’s production route but it even now expected Brent to achieve $80 a barrel early following 12 months.

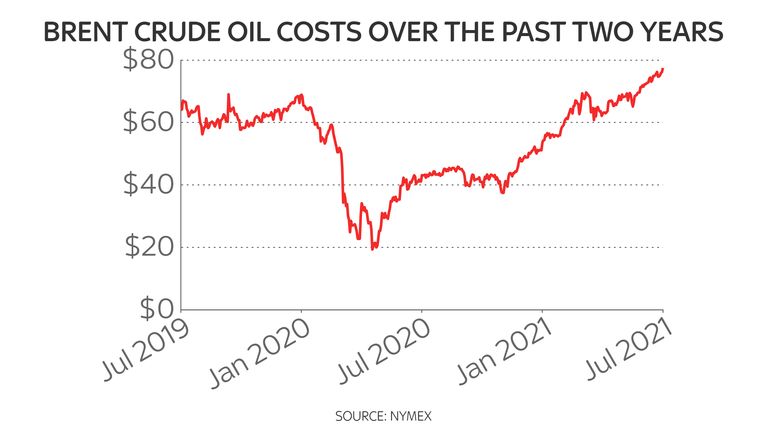

Following a crash for charges at the start off of the COVID-19 pandemic, production curbs had been agreed by the OPEC+ nations to assist guidance their oil incomes.

But price ranges have been mounting steadily this year as economies have reopened from pandemic-pushed lockdowns.

Demand for oil, thus, has lifted and so have rates.

But this has seen gasoline prices rise for households, almost hitting 8-year highs.

It also problems central bank policymakers, due to the fact surging energy expenses have been the main source of inflation, which is a potential barrier to financial recoveries.