Never decide on a battle with us more than City entry, BoE manager warns Brussels | Company News

3 min readFinancial institution of England Governor Andrew Bailey has urged the EU not to pick a combat in excess of submit-Brexit obtain for monetary companies and accused it of demanding tougher expectations of the Uk than other nations.

Brussels has been sluggish to grant “equivalence” standing permitting British isles corporations obtain to the bloc in the way that has already been granted to Canada, the US, Australia, Hong Kong and Brazil.

That was despite the United kingdom beginning off from a situation of pursuing the identical policies as the EU, as opposed to those nations around the world, Mr Bailey pointed out.

He said that the EU’s situation was that it wished to “improved fully grasp how the United kingdom intends to amend or change the principles heading forwards”.

But Mr Bailey claimed: “This is a normal that the EU retains no other region to and would, I suspect, not concur to be held to by itself.”

The governor explained it appeared to indicate Brussels was either having the “unrealistic, dangerous and inconsistent” look at that regulations really should not be adjusted in the future or that if they do, the United kingdom ought to not do so independently of the EU.

That would be “rule-having pure and uncomplicated” and “not suitable”, Mr Bailey reported in a speech to economical executives.

He claimed that did not indicate the United kingdom was out to create a “reduced regulation, high danger, just about anything goes financial centre and method”.

Nevertheless, he argued “as the earth moves on, so the principles need to have to adapt”.

Britain is presently hunting at easing “significant obligation” worldwide banking rules for smaller financial institutions, in a comparable way that the US and Switzerland do, Mr Bailey said.

But it is also hoping to opt out of EU designs to drinking water down the way creditors can evaluate the degree of capital they keep in circumstance of anxiety.

Guidelines for the insurance sector are also currently being reviewed.

Mr Bailey reported the Uk had “a quite vivid upcoming competing in global fiscal markets underpinned by strong and efficient common world wide and regulatory requirements”.

He mentioned the planet experienced “the prospect to go forward and rebuild our economies, submit COVID, supported by our economic devices”, including: “Now is not the time to have a regional argument.”

London, Europe’s pre-eminent economical centre, dominates investing in the multi-trillion dollar forex marketplaces but its firms no for a longer period delight in “passporting” obtain to the EU.

That has pushed a selection of firms to change assets absent from the City and established up or extend operations in other hubs this sort of as Dublin, Frankfurt and Paris.

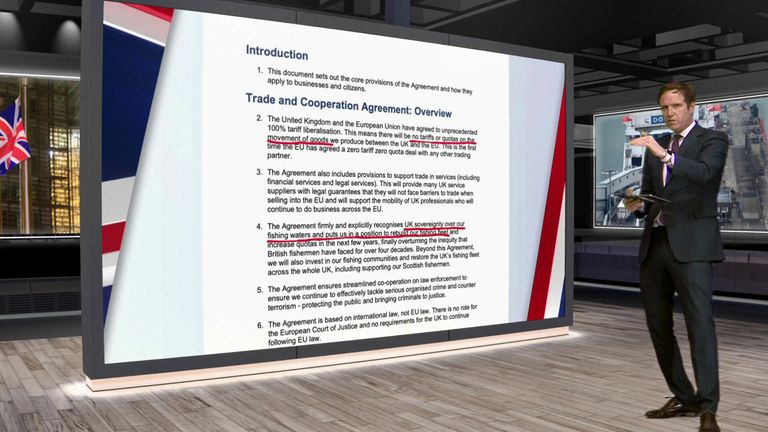

Britain’s new trade offer with the bloc, which took influence on 1 January, does not protect money solutions and the City looks established to be offered only “equivalence” dependent access for the foreseeable future.

PwC has approximated that Britain’s tax receipts from the money companies sector – now accounting for a lot more than 10% of the full – are set to start slipping this 12 months as a consequence of Brexit and the effects of the pandemic.