Here’s Why SKY Network Television (NZSE:SKT) Can Control Its Credit card debt Responsibly

5 min readThe exterior fund supervisor backed by Berkshire Hathaway’s Charlie Munger, Li Lu, makes no bones about it when he claims ‘The major financial investment chance is not the volatility of costs, but regardless of whether you will go through a long term decline of money.’ So it looks the wise money is familiar with that credit card debt – which is commonly involved in bankruptcies – is a pretty essential variable, when you assess how dangerous a firm is. We can see that SKY Network Tv Confined (NZSE:SKT) does use credit card debt in its company. But should shareholders be anxious about its use of debt?

Why Does Personal debt Deliver Threat?

Typically talking, personal debt only results in being a actual problem when a company won’t be able to effortlessly shell out it off, either by increasing cash or with its personal cash move. If matters get seriously terrible, the creditors can choose control of the business enterprise. On the other hand, a more popular (but even now agonizing) state of affairs is that it has to elevate new fairness funds at a reduced rate, as a result permanently diluting shareholders. Of program, the upside of personal debt is that it typically represents low cost money, especially when it replaces dilution in a firm with the ability to reinvest at superior prices of return. When we think about a firm’s use of debt, we initially search at funds and personal debt with each other.

See our most current investigation for SKY Network Television

What Is SKY Network Television’s Personal debt?

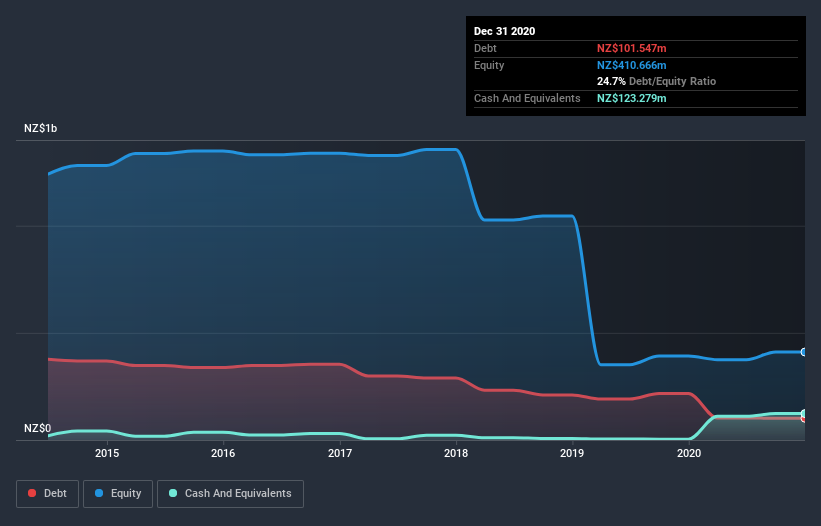

The graphic down below, which you can click on for better element, exhibits that SKY Network Tv experienced debt of NZ$101.5m at the finish of December 2020, a reduction from NZ$217.0m more than a yr. Having said that, it does have NZ$123.3m in cash offsetting this, major to net dollars of NZ$21.7m.

How Nutritious Is SKY Network Television’s Equilibrium Sheet?

The most current equilibrium sheet knowledge reveals that SKY Network Television had liabilities of NZ$325.3m thanks inside of a 12 months, and liabilities of NZ$57.9m falling due after that. Offsetting these obligations, it experienced funds of NZ$123.3m as very well as receivables valued at NZ$54.1m thanks within 12 months. So its liabilities total NZ$205.8m more than the blend of its income and small-phrase receivables.

This deficit is sizeable relative to its market capitalization of NZ$314.4m, so it does recommend shareholders need to continue to keep an eye on SKY Community Television’s use of personal debt. This suggests shareholders would be greatly diluted if the business desired to shore up its stability sheet in a hurry. Though it does have liabilities really worth noting, SKY Network Tv also has more dollars than debt, so we are rather self-confident it can control its debt safely and securely.

Also excellent is that SKY Network Television grew its EBIT at 16% in excess of the final year, further more escalating its potential to deal with debt. The stability sheet is plainly the spot to target on when you are analysing debt. But ultimately the future profitability of the enterprise will determine if SKY Network Tv can fortify its stability sheet over time. So if you want to see what the gurus think, you may possibly locate this no cost report on analyst financial gain forecasts to be intriguing.

But our ultimate thing to consider is also important, for the reason that a organization cannot shell out personal debt with paper income it requires chilly hard hard cash. SKY Network Tv might have net funds on the harmony sheet, but it is however interesting to look at how properly the organization converts its earnings in advance of curiosity and tax (EBIT) to free of charge dollars move, mainly because that will impact the two its need to have for, and its potential to deal with personal debt. In the course of the previous 3 years, SKY Community Television generated free of charge hard cash move amounting to a very sturdy 87% of its EBIT, a lot more than we’d anticipate. That positions it nicely to spend down debt if appealing to do so.

Summing up

Whilst SKY Community Television’s equilibrium sheet isn’t specially sturdy, due to the complete liabilities, it is plainly favourable to see that it has web cash of NZ$21.7m. And it amazed us with free of charge money circulation of NZ$123m, remaining 87% of its EBIT. So we don’t have any dilemma with SKY Community Television’s use of financial debt. The stability sheet is obviously the location to concentrate on when you are analysing credit card debt. But in the long run, each and every organization can consist of threats that exist exterior of the stability sheet. To that end, you really should be informed of the 1 warning sign we have spotted with SKY Community Television .

If you might be intrigued in investing in organizations that can expand gains without the load of personal debt, then verify out this cost-free checklist of developing organizations that have web cash on the stability sheet.

Promoted

If you are seeking to trade SKY Community Television, open an account with the most affordable-charge* platform trusted by gurus, Interactive Brokers. Their customers from over 200 nations and territories trade stocks, possibilities, futures, forex trading, bonds and money around the world from a single built-in account.

This write-up by Simply just Wall St is general in character. It does not constitute a advice to buy or market any inventory, and does not consider account of your targets, or your economic scenario. We purpose to bring you long-term centered investigation driven by basic knowledge. Note that our examination might not variable in the hottest value-sensitive organization bulletins or qualitative materials. Simply Wall St has no placement in any stocks described.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Once-a-year Online Review 2020

Have suggestions on this short article? Involved about the material? Get in touch with us specifically. Alternatively, electronic mail editorial-group (at) simplywallst.com.