Here’s what key voices from the world of business and markets told CNBC-TV18 today

2 min read

3 years ago

Marlene M. Karmen

Market

Updated : 2021-02-03 17:43:35

Here is what market gurus and industry captains said about the near-term trajectory on February 3, 2021.

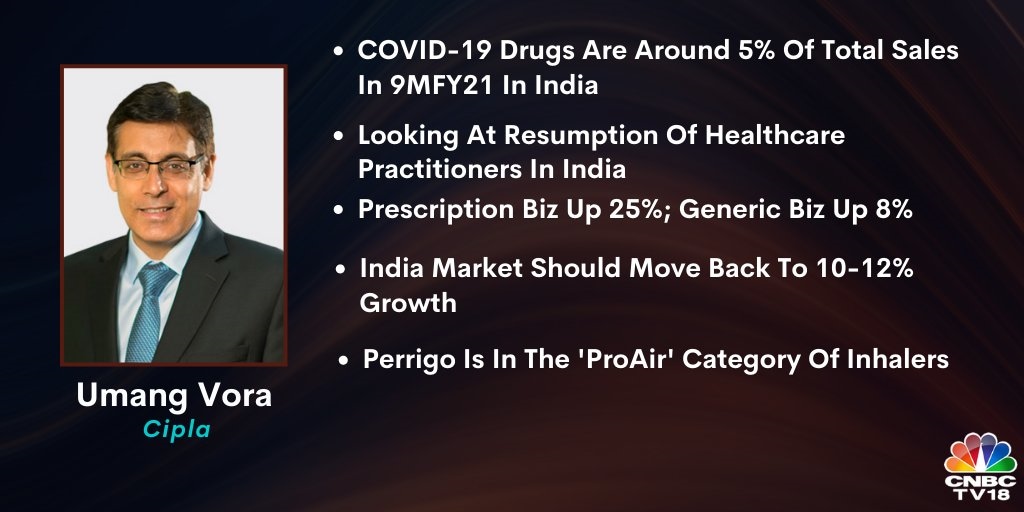

On Cipla: COVID drugs are at about 5 percent of our total mix on a nine-month period, which would roughly be the COVID portfolio for India. From a key trend perspective, we are looking at the resumption of healthcare practitioners across India. We are beginning to see volume growth return, which is significant. We had strong growth across three therapies. On our prescription business, we have seen the growth of almost 25 percent, and generic business is showing robust growth of 8 percent. The consumer healthcare business is on an overdrive considering the brands that are switching. Catch the conversation here.

On Neuland Labs: A 15-20 percent growth over 3-5 years will be reasonable for Neuland Labs. Three key factors that drive our revenue and profit growth are the pricing of our products, cost of the raw material and the foreign exchange rate because 90 percent of our revenues are from exports. We tend to be a little bit conservative on how we budget this over a 3-5 year horizon and keeping those conservative estimates in mind, we think a 15-20 percent growth rate over a 3-5 year period is reasonable. Catch the conversation here.

On KPIT Technologies: We had mentioned that the second half (H2) of the year will be much stronger than H1. Therefore, in light of operational efficiencies, revenue mix and consolidation of facilities, we had said that Q4 momentum, both on the topline and the bottomline will continue. For the next 3-4 years, spends in Europe and US will aid growth. Therefore, we believe that next 3-4 years will be an exciting opportunity specifically for a focused players like us. Catch the conversation here.

On Castrol India: Castrol India has delivered a robust financial performance in 2020 but also set the business for growth. We continue to introduce new products. We have introduced three new products in the second half of 2020. I am very buoyant in 2021 with the recovery that we are seeing and definitely, we should have a good year ahead of ourselves in terms of growth. The company is confident of maintaining the margin levels, he said. Catch the conversation here.

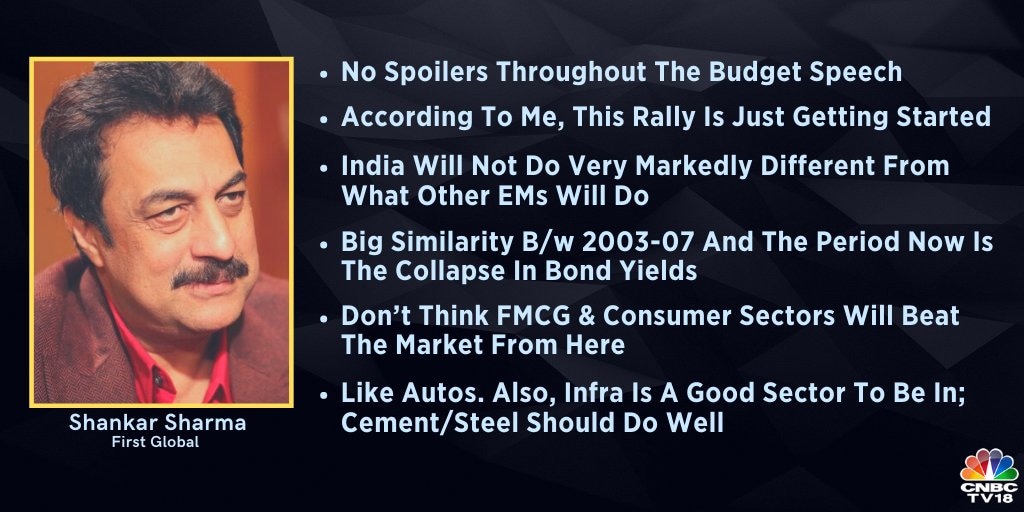

On Markets’ reaction to Budget: Let us not start thinking that markets have rallied a lot in the last week or last 2-3 days, I think we are just getting warmed up here. I don’t want to sound anti-national here, but we need to understand that we are in the middle of a very strong environment for emerging markets (EM) equities. Emerging markets have been doing well. In the overall ranking of markets in 2020 calendar performance, India was number 21. So there were other emerging markets which did far better. Catch the conversation here.