Here is the upcoming Tata group firm headed for an IPO

3 min readTata Sky, the satellite tv small business of the Tata group, will shortly file draft share sale paperwork with the markets regulator for an preliminary public featuring (IPO) by close-March, two folks mindful of the progress explained.

“Work on the draft IPO prospectus is in innovative stages and could be submitted with Sebi (Securities and Trade Board of India) by future thirty day period so, the offer could probably be introduced before the conclude of this fiscal,” one of the two people today said. Kotak Mahindra Cash is advising Tata team on the IPO, the man or woman said, incorporating a few of overseas financial commitment financial institutions are also included.

The proposed IPO’s dimensions may well be ₹2,000-3,000 crore, with a combine of main capital raising for use in the business and secondary share gross sales by existing buyers, the next human being said.

Look at Comprehensive Graphic

The IPO will present an exit to investors, particularly Disney, which has been looking to market its stake, the people cited earlier mentioned claimed, requesting anonymity.

“Disney does not have investments in any other distribution system aside from Tata Sky. This is non-core for them, and they want to concentrate on their primary buyer-focused business enterprise of Disney+, offered the fierce competitors in the OTT current market. Other choices were explored in the earlier to either convey in a strategic trader or Tatas getting Disney’s stake but right now, it looks like the IPO is the way ahead for the company,” reported the next particular person.

“There are other investors, much too, this sort of as Temasek and Tata Money, who have been invested in the business for a very long time. They, also, would like to dilute some of their stake. Disney, much too, will promote component of its stake in the IPO,” he additional.

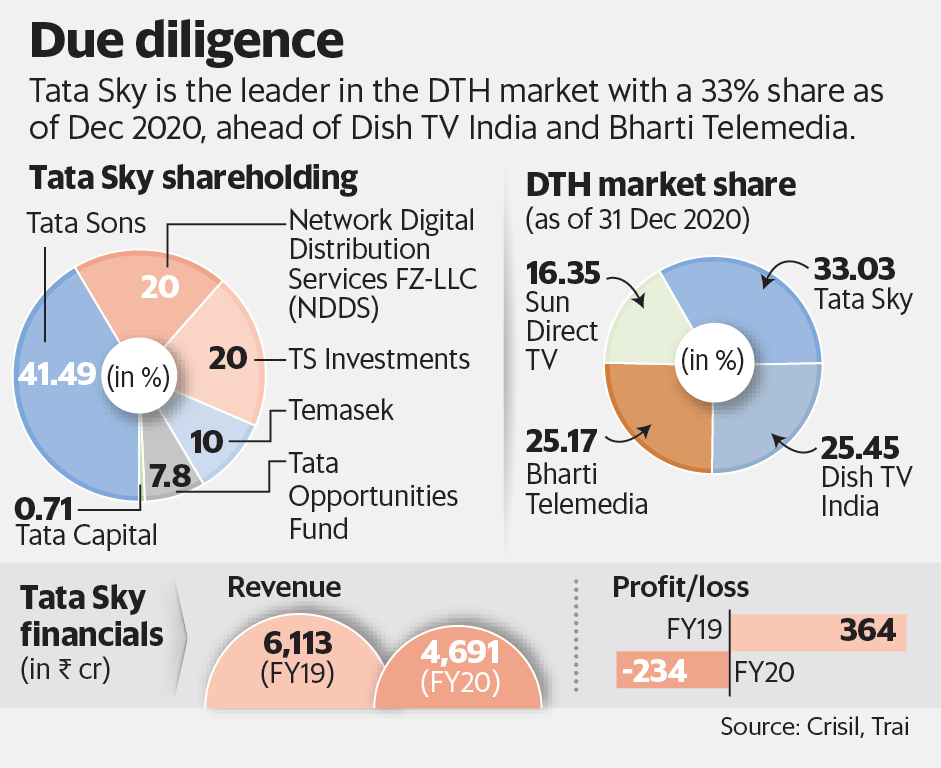

Tata Sky begun operations in 2004 as an 80:20 joint undertaking concerning Tata Sons and Community Digital Distribution Companies FZ-LLC, an entity owned by Rupert Murdoch’s 21st Century Fox. Disney obtained Fox in 2019. Disney owns an extra 9.8% stake in Tata Sky by way of TS Investments Ltd, the place Fox owned a 49% stake, with Tata owning the relaxation. In FY08, Baytree Investments (Mauritius) Pte Ltd (Bay Tree), an affiliate of Temasek, obtained a 10% stake in Tata Sky, when in FY13, Tata Chances Fund and Tata Cash Ltd obtained an fairness stake in the firm. Tata Sons has a 41.49% stake in the enterprise.

Temasek and Tata Cash declined to remark. E-mails sent to Tata Sons and Disney remained unanswered till push time.

Tata Sky is the chief in the DTH market place with a 33% share as of December 2020, forward of Dish Tv India, Bharti Telemedia and Sun Direct Television, whose marketplace share stood at 25.45%, 25.17% and 16.35%, respectively, according to a report by the Telecom Regulatory Authority of India (Trai). Tata Sky’s market share went up from 32.3% as of 31 March 2020, knowledge demonstrates.

Even with covid, the whole lively subscriber foundation for the DTH industry has developed from 70 million at the conclusion of 2019 to 71 million as of 31 December 2020, Trai facts exhibits.

“(Tata Sky’s) industry place has strengthened with the implementation of NTO 1. (new tariff purchase), ensuing in a sharp addition of buyers, and is supported by the premier high-definition subscriber base in the market,” rating company Crisil stated in a notice in October 2020.

For FY20, Tata Sky noted a fall in earnings to ₹4,691 crore from ₹6,113 crore in the former year. The firm claimed a reduction of ₹234 crore in FY20 from a earnings of ₹364 crore in the past yr.

“The field entails huge capex as operators require to undertake major institution cost (this kind of as installation companies) and working charges (such as promoting ) to make sure sustained ramp-up in scale. Tata Sky faces rigorous opposition. In addition, DTH operators confront the possibility of technological obsolescence,” Crisil mentioned.

By no means miss out on a tale! Remain linked and informed with Mint.

Download

our App Now!!