Hedge cash could be staging a comeback as small bets submit very best month since 2010

A trader operates on the trading flooring at the New York Inventory Trade (NYSE), August 5, 2021.

Andrew Kelly | Reuters

Limited promoting is booming yet again immediately after virtually staying left for dead because of to the GameStop mania, reviving hope that hedge resources could flip issues all around in 2021.

Hedge funds’ brief e book produced in July the ideal alpha since 2010, and now it is really outperforming the extensive facet of their techniques, in accordance to Morgan Stanley prime brokerage information.

The rebound came right after a difficult start out to the 12 months when the monstrous GameStop shorter squeeze inflicted massive pain for shorter sellers betting towards the brick-and-mortar retailer. As the meme inventory trend unfold, it prompted hedge funds to near out quick bets and in typical acquire on less chance.

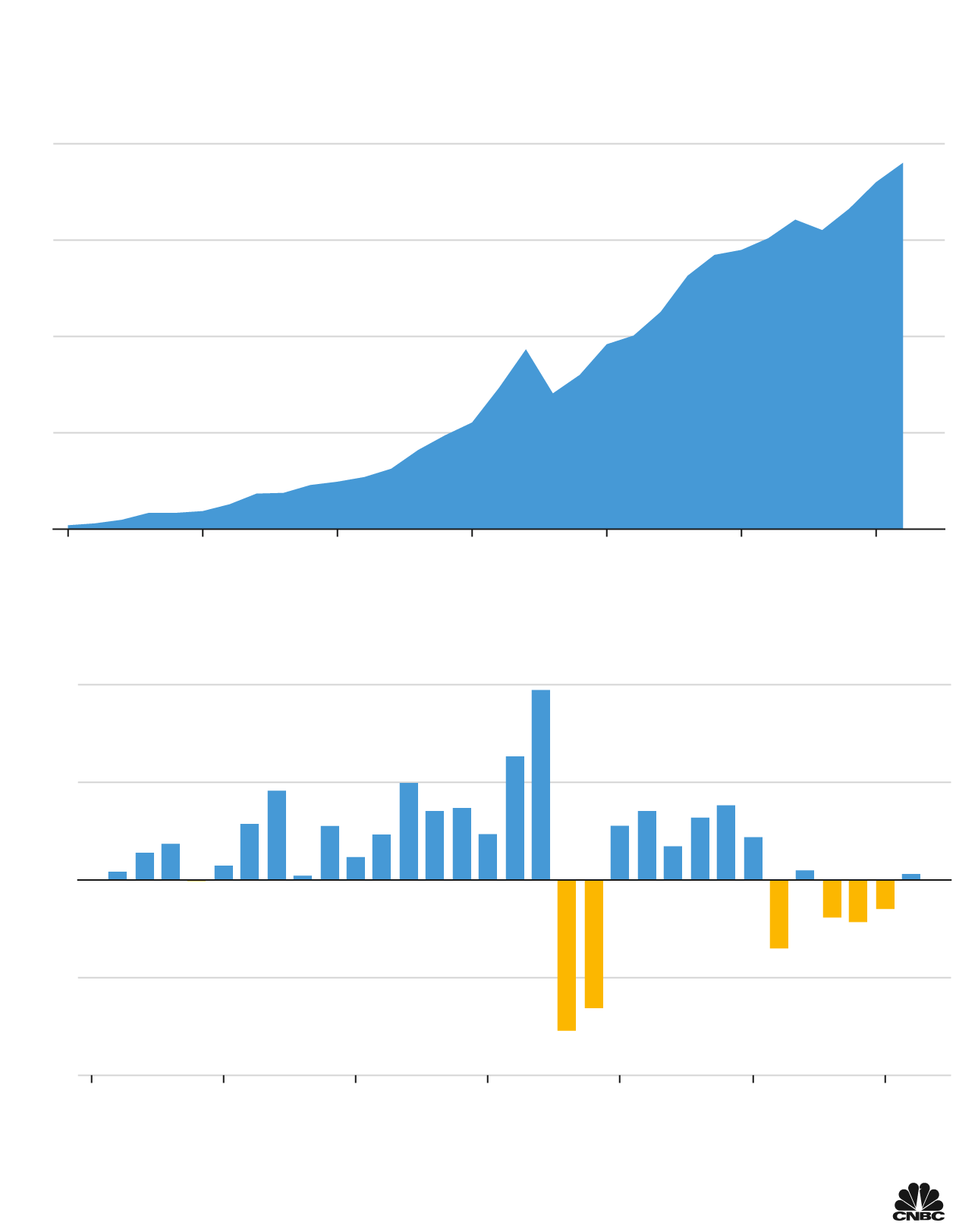

The outperformance in the bearish bets is great information for hedge resources that are beginning to arrive into favor once more just after a decade of mediocre efficiency pushed cost-conscious investors away. After 3 straight years of outflows, hedge money observed a lot more than $6 billion consumer inflows in the initial quarter, pushing the industry’s whole property beneath administration to a report of $3.8 trillion, according to HFR info.

Estimated assets under administration

Be aware: 2021 facts is through the first quarter.

Source: HRF

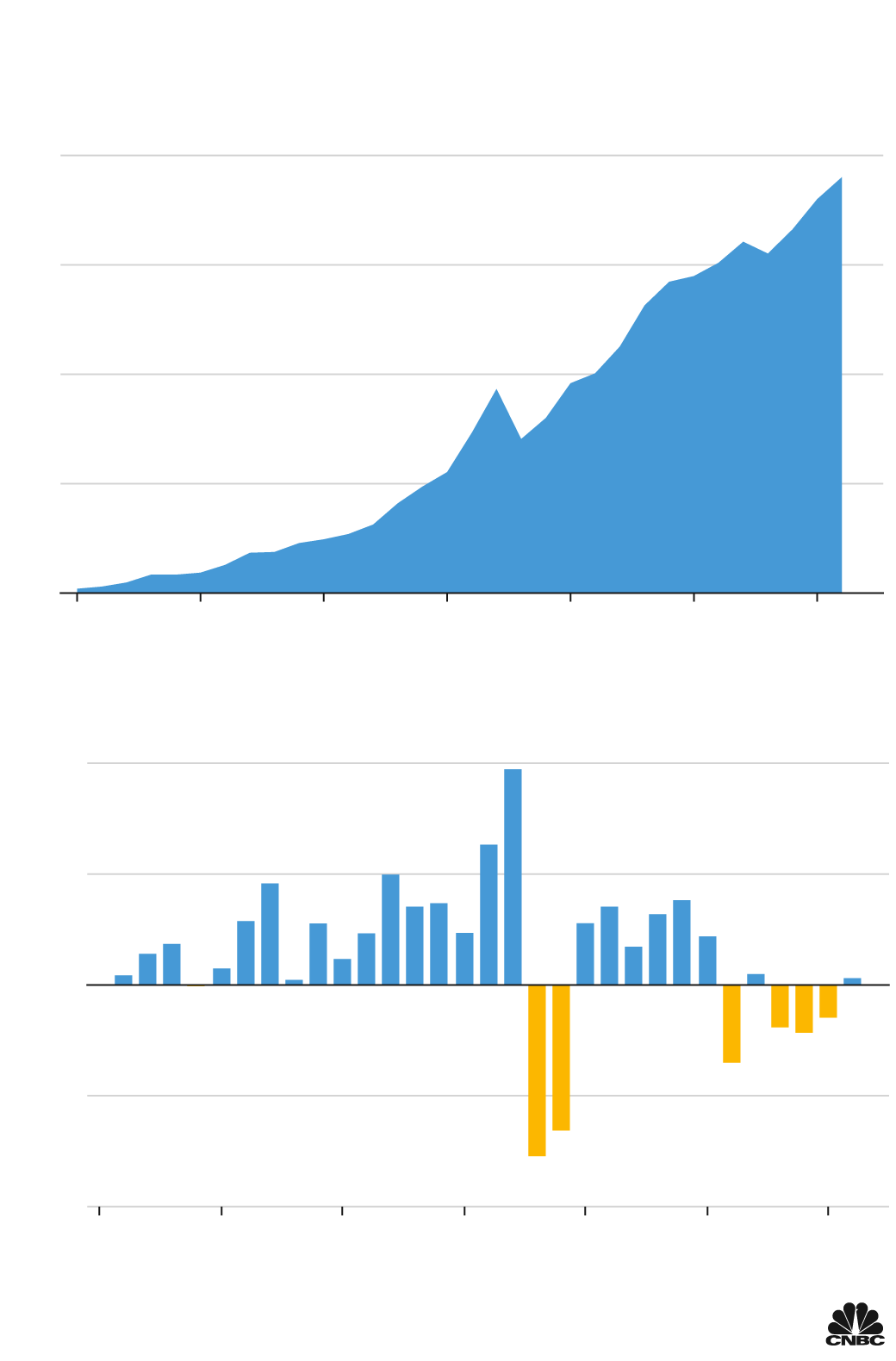

Believed property less than administration

Note: 2021 data is by the 1st quarter.

Source: HRF

Believed property underneath management

Take note: 2021 details is as a result of the initial quarter.

Source: HRF

“Investors are turning to different investments for steady returns to keep in the marketplace right after a powerful rally to file highs,” said Greg Bassuk, CEO of AXS Investments. “Hedge resources also have the part of draw back security from the threats of Covid and the Fed tapering.”

The stars appeared to be aligning for a hedge-fund revival. For starters, volatility has built a comeback amid a laundry list of macro dangers, from a worsening pandemic to the pullback of financial stimulus and slowing economic expansion.

In the meantime, inventory correlation has fallen to an all-time very low from a peak in March 2020, making an ideal surroundings for stock pickers, according to Bernstein.

“It is easier to select winners and losers in an environment where stocks are not transferring in the same course in an intense way,” Sarah McCarthy, international quant and fairness strategist at Bernstein, reported in a observe.

Hedge funds have obtained 9.2% in 2021 by the conclusion of July, according to HFR. They are nevertheless lagging the market significantly, as the S&P 500 climbed 17% for the duration of the identical interval.

— CNBC’s Nate Rattner contributed to this tale.

Savored this article?

For exclusive stock picks, expense ideas and CNBC international livestream

Indication up for CNBC Professional

Start your free demo now