Greensill stripped of govt promise on loans to steel tycoon Gupta | Small business Information

4 min readBritain’s point out-owned company bank has stripped Greensill Funds of a governing administration promise on loans to the metals tycoon Sanjeev Gupta’s empire, immediately after determining it had breached the terms of pandemic lending programmes.

Sky Information has learnt that the British Small business Bank (BBB) has knowledgeable Greensill that it is taking away a taxpayer warranty subsequent an investigation into the British isles-centered fintech company’s compliance with the policies of the Coronavirus Substantial Small business Interruption Bank loan Scheme (CLBILS).

Town resources reported that EY, the accountancy agency, and Hogan Lovells, the legislation organization, experienced been drafted in by the governing administration to assess no matter if Greensill was in breach of the CLBILS regulations.

A person banking insider reported the advisers experienced concluded in recent days that the conditions experienced been breached in relation to places this sort of as the adequacy of the safety taken by Greensill in excess of assets owned by GFG Alliance, the community of providers headed by Mr Gupta.

If enforced, the removing of the govt assure could depart Greensill on the hook for considerable sums if GFG finally defaults on the bank loan repayments.

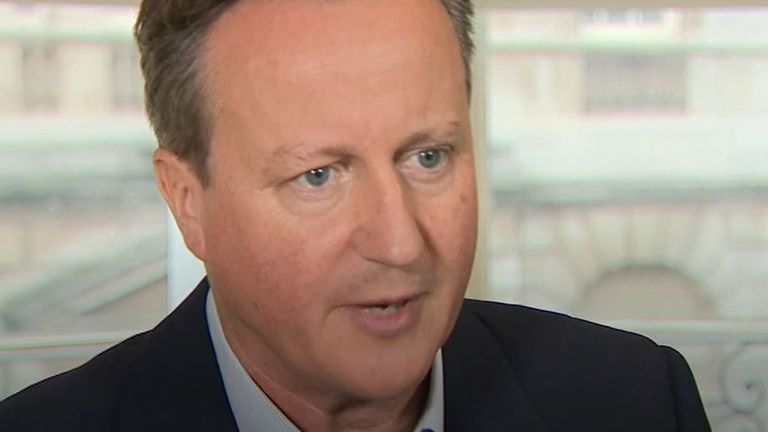

The move will deepen the feeling of crisis engulfing Greensill, which counts the previous key minister David Cameron as a senior adviser.

The BBB, GFG and Greensill all declined to remark on Monday evening, but none disputed the recommendation that the group driving Britain’s third-most significant metal producer had borrowed various hundred million pounds from Greensill beneath the CLBILS programme.

It was unclear regardless of whether the BBB had taken motion to strip any other lender of its governing administration promise on loans made underneath CLBILS or its smaller counterpart, CBILS.

Below the strategies released early in the COVID-19 crisis by Rishi Sunak, the chancellor, taxpayers assure 80% of the price of the mortgage, despite the fact that borrowers continue to be entirely liable for the personal debt.

The CLBILS programme has been extended right up until the stop of the month, and Mr Sunak programs to established out further specifics of a successor plan in his Finances on Wednesday.

The news that the BBB has moved to strip Greensill on the federal government assure relating to Mr Gupta’s providers will even further strengthen the unease which has grown over the inbound links between them.

On Monday, it emerged that Greensill was in talks about a $100m sale of its operating company to Apollo International Management, with the option final result a achievable administration taken care of by Grant Thornton.

Talks in between Greensill and Apollo were being exposed by Sky News past month, even though the Wall Road Journal was to start with to report details of the deal’s potential structure, like the possible insolvency procedure.

A conclusion by Credit history Suisse to freeze $10bn of funds connected to Greensill appeared to have remaining the fintech with couple of solutions just weeks right after pursuing talks with other buyers about a fundraising that it planned to value it at $7bn.

“We continue to be in sophisticated talks with likely exterior traders in our business and hope to be ready to update more on that system imminently,” Greensill claimed on Monday.

Mr Cameron has been an adviser to the enterprise due to the fact 2018 right after forging a near marriage with Lex Greensill, its founder.

The company has elevated billions of bucks in fairness from shareholders which includes SoftBank’s Eyesight Fund, which has backed notable tech companies which includes Uber Technologies, WeWork and the British augmented fact start-up Improbable.

Typical Atlantic, the non-public equity firm, is also an trader.

Greensill helps clients regulate hard cash by paying their suppliers early in return for a discounted.

In accordance to company data, it furnished a lot more than $143bn to additional than 10 million consumers and suppliers in 2020.

It describes itself as the world’s leading non-lender company of provide chain finance.

Greensill also provides a string of other goods, such as Earnd, an early-payment assistance which counts the NHS between its purchasers.

It is not distinct what affect an insolvency could have on the provision of this sort of expert services.

The move of functioning cash finance has turn into significantly crucial for the duration of the pandemic, specially for modest businesses which have been damage by an acute cashflow squeeze.

Final yr, suppliers of these funding like Greensill held talks with the Treasury and Bank of England about the creation of a programme to support British isles SMEs in the course of the coronavirus crisis.

The governing administration sooner or later made a decision in opposition to launching the plan.

The organization has develop into a single of the premier fintech corporations in Britain, achieving a $4bn valuation in 2019 when it raised funding from buyers led by SoftBank’s large Eyesight Fund.

Nevertheless, it has faced growing scrutiny about the previous calendar year of its near back links to Mr Gupta, who controls Liberty Metal.

Greensill was also explained to have been rebuffed by a quantity of huge accountancy firms in its research for a new auditor.