GameStop share frenzy stopped in its tracks as value plunges 50% | Enterprise News

Shares qualified by armchair buyers to inflict losses on hedge cash this yr have fallen sharply in a sign the activism could have peaked.

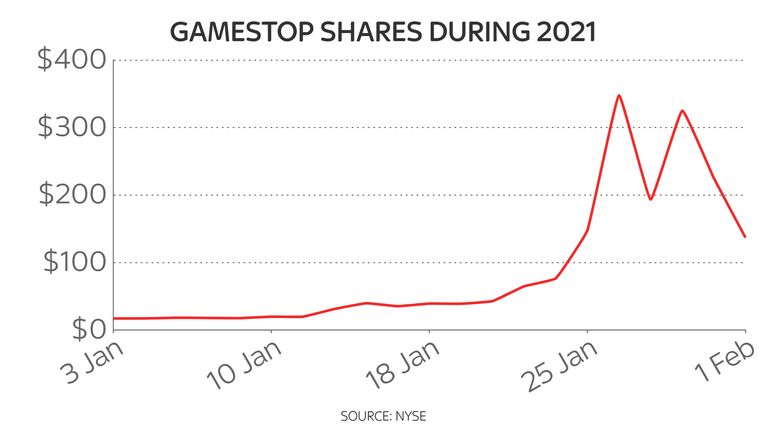

The industry benefit of GameStop – a having difficulties US gaming retailer – plunged by up to 50% on Tuesday to roughly $105 a share amid a rollercoaster trip for the inventory in the previous couple weeks.

It was the very first corporation to benefit from a surge in desire, co-ordinated by customers of a discussion board on Reddit, that culminated in shares nearing $500 every last month from a lowly $20.

The market shift on GameStop inflicted heavy losses on hedge funds and other so-named short-sellers – people betting that the share price tag will tumble – and was viewed as a obstacle to the Wall Street institution.

The frenzy has been produced easier by the surge in attractiveness in zero-commission trading platforms throughout the coronavirus crisis – applications, these types of as Robinhood, that have been pressured to raise funds and latterly prohibit investing to fulfill the needs placed on their functions.

AMC Amusement, an additional of the shares to have benefited from the unparalleled action of the past fortnight, was 40% down at just one stage on Tuesday.

BlackBerry and Bed Bathtub & Beyond also showed double-digit declines.

Paul Nolte, portfolio manager at Kingsview Asset Management in Chicago, claimed of the market place movements: “The rally is possible about (since) the quick positions are very properly taken care of.

“That is the game you participate in when you do this detail. It can function for a though till it stops performing and when it stops performing, it reverses fairly quickly.”

Spot silver charges, a commodity to have been caught up in the fad, fell additional than 7% soon after hitting an 8-12 months significant on Monday.

Traders explained significant tech corporations were the major winners on Tuesday, as Google‘s mother or father Alphabet and Amazon well prepared to produce earnings statements immediately after the market place close.

Uber rose 7% just after the company mentioned it would get alcoholic drink shipping and delivery service Drizly for $1.1bn.