GameStop share frenzy commences once more as platforms simplicity restrictions | Small business News

Shares in US retailer GameStop have surged at the time additional as on-line investing platforms lift restrictions temporarily placed on the army of armchair buyers battling hedge resources and other shorter-sellers.

The stock jumped by a lot more than 80% at Friday’s open – triggering a protection mechanism that halted investing quickly – pursuing sharp falls the working day in advance of as fee-free brokerages struggled to handle the volumes of investing and new client requests.

Platforms together with Robinhood, Trading212 and Interactive Brokers prepared a return to standard operations on Friday as the assault on Wall St, which has witnessed retail buyers collaborate in their millions by way of social media discussion boards, ongoing apace.

Newbie traders have been getting the shares this month to try out to experience swift gains and impose losses on hedge cash and other so-identified as small-sellers who betted billions on the firm’s price falling.

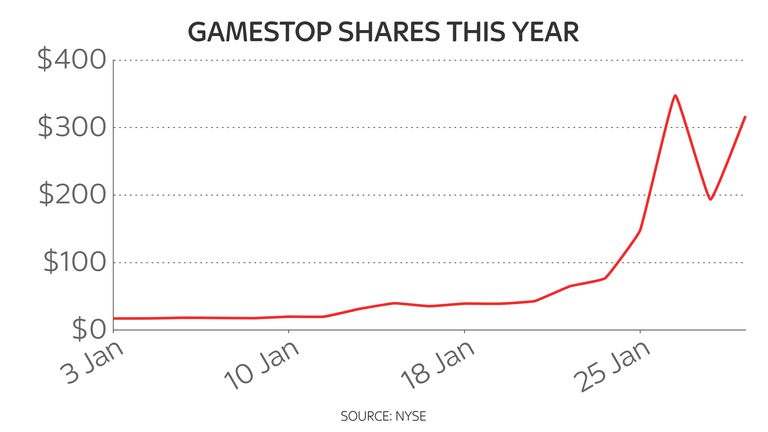

Shares in the online video activity chain ended up up 1,744% by close of trading in New York on Wednesday – heading from below $20 earlier in January to around $350.

But they slipped by 40% on Thursday as restrictions ended up imposed by the on-line platforms.

The price rose to $354 prior to the so-known as circuit breaker was carried out in early Friday promotions as brokerages acquired to grips with a flood of instructions.

Nevertheless, just one London-primarily based brokerage Freetrade said that it experienced disabled get orders for US stocks due to the fact its international exchange provider and lender experienced unexpectedly asked it to limit trade volumes.

The enterprise experienced before employed an job interview with Sky News to say it was fast paced “educating” investors on the present-day sector pitfalls.

Robinhood, which was amongst these to encounter an offended backlash from consumers when it pulled investing, was noted by the New York Instances to have lifted $1bn in emergency funding late on Thursday to meet demand from customers.

The astonishing share value gains have prompted US regulators to evaluation the action as fears mount around the growth in retail investors – non-marketplace specialists – coordinating a tactic on line.

The Securities and Trade Fee warned market place participants ahead of Friday’s working that they must be watchful not to break policies masking the “manipulation” of shares and that issuers meet up with their compliance necessities.

The UK’s Economic Perform Authority instructed Sky News on Thursday that it was monitoring the problem.

The volatility of latest times is envisioned to continue.

It has gripped the broader markets since hedge cash and other folks to have shed heavily on their positions have been offering other shares to cover their losses.

The action has been blamed for jitters globally in new days.

It has pitted inventory current market industry experts in opposition to the armchair investor, whose numbers have swelled through the coronavirus disaster as they seek to make their revenue get the job done for them at a time of ultra-reduced fascination costs.

US politicians are to mount an inquiry amid fears that the tidal wave of trader activism could pose a threat to the monetary method.

Nevertheless, some joined criticism of on the net trading solutions that limited smaller traders trading GameStop and shares in other organizations like Nokia and Blackberry – which also saw robust rises in their US-mentioned shares on Friday.

Democrat agent Alexandria Ocasio-Cortez mentioned the final decision to suspend dealing by Robinhood, arguably the most higher profile zero-fee platform, was “unacceptable” and that she would aid a listening to on why it blocked compact buyers though loaded monetary establishments “are freely in a position to trade the stock as they see healthy”.

The CEO of Robinhood – whose company’s intention is to “democratize” investing and has about 13 million customers – stated it had acted “pre-emptively” to safeguard the enterprise and its buyers from opportunity losses.

Vlad Tenev also explained to CNBC that the transfer had not been prompted by any hedge fund.

The surge was partly fuelled by people sharing ideas on sites these kinds of as Reddit – namely the wallstreetbets board – as nicely as private Fb groups this kind of as “Robin Hood’s Inventory Market Watchlist”.

That platform was taken down by Fb on Friday which cited violations of its working problems for the move.

A single trader posted screengrabs on Reddit suggesting he experienced turned an first financial investment of $53,566 (£39,061) into a person worth additional than $25m (£18.2m) at 1 place this week.

Including to the pleasure of individuals buyers – which consists of a further team on the social media system TikTok – has been the irritation of those on the losing aspect of the trade.

Limited-sellers are loathed by numerous non-public buyers for the positions they get towards some businesses and, in the course of action, contributing to falls in their share rate.

Quite a few of these are hedge money and a selection of them have been caught out poorly by the surge in GameStop shares.

Pleasure at tweaking the tail of these brief-sellers is not, however, confined to the small traders on Reddit, Fb and TikTok.

Elon Musk, who in the past has commonly railed against hedge money for driving down the rate in shares of Tesla, tweeted on Tuesday evening: “Gamestonk!!”

A further recent tweet of his has been credited for driving up the charge of Bitcoin by 13%.