Funds 2021: United kingdom Corporate Tax Base

3 min readWednesday, the United Kingdom will publish its 2021 finances, immediately after the fall spending plan was delayed due to the pandemic. In addition, the United kingdom govt will start many consultations on the potential of the country’s tax method on March 23. Changes to the corporation tax—particularly an raise in the UK’s 19 percent company tax rate—are reportedly between the reforms less than consideration.

When the United kingdom is searching at techniques to elevate tax revenue to cover the profits shortfalls and additional spending ensuing from the COVID-19 pandemic, limited- as properly as extended-phrase, investment will be critical in receiving the economic system back on observe and making certain economic growth. Corporation tax coverage can enjoy a central role listed here having said that, the concentrate ought to be on alterations to the tax foundation somewhat than the tax price.

Additional precisely, accelerated depreciation—or whole expensing—of cash assets would lower the marginal effective tax rate on expenditure, building new financial commitment a lot less expensive. This, in turn, could increase financial investment and consequently economic expansion. A quantity of OECD countries—including Australia and Germany—have presently carried out accelerated depreciation for many belongings in 2020 to spur expenditure.

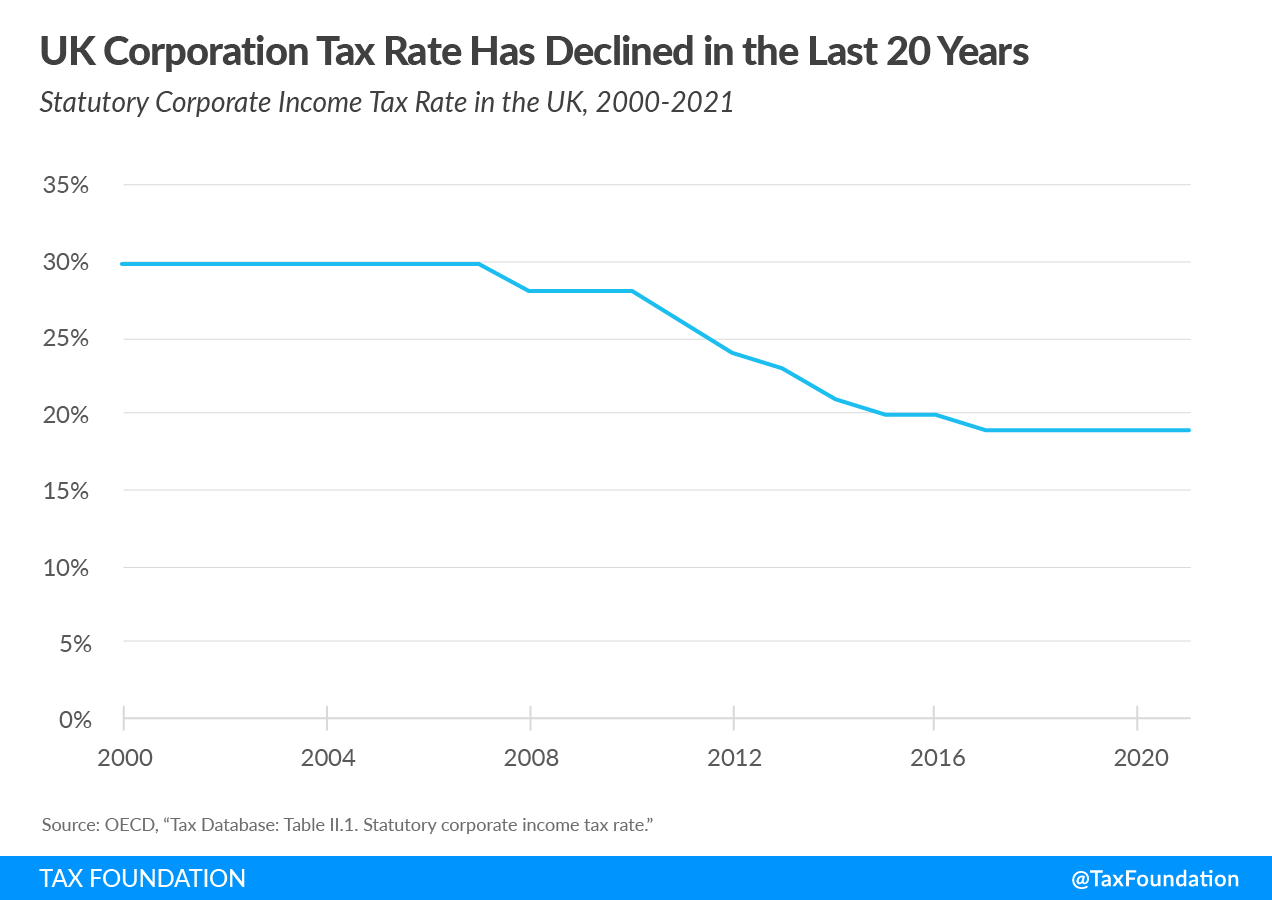

Around the earlier two many years, the British isles has reduced its company income tax fee from 30 percent in 2000 to 19 per cent because 2017.

On the other hand, these reforms have frequently been paired with base-broadening steps that penalize new small business financial investment. Involving 2008 and 2013, the United Kingdom reduced the benefit of depreciation deductions for machines and industrial properties. The existing benefit deduction (the % of the value of an expense a organization can deduct about its daily life) for machines fell from 83 p.c to 76 p.c in between 2008 and 2013. More than the similar period, the current value deduction for industrial properties fell from 48 p.c to zero.

Just in 2019, the United kingdom reinstated a 2 percent annual allowance for industrial structures, which was expanded to 3 p.c in 2020, now allowing a price deduction of 62 percent. Inspite of this coverage transform, the UK’s capital allowances are on average however reduce than in France and the U.S., and on par with Germany.

| Country | Machinery | Industrial Buildings | Patents | Weighted Ordinary |

|---|---|---|---|---|

| France | 88% | 55% | 87% | 74% |

| United States | 100% | 35% | 63% | 68% |

| United Kingdom | 76% | 39% | 83% | 62% |

| Germany | 74% | 39% | 87% | 62% |

|

Notice: Calculations assume a fixed inflation fee of 2.5 p.c and mounted fascination amount of 5 per cent to estimate the current discounted values. The average is weighted by the capital stock’s respective share in an economy (equipment: 44 % industrial structures: 41 per cent and intangibles: 15 p.c). Resource: Elke Asen, “Capital Cost Restoration throughout the OECD,” Tax Basis, Apr. 8, 2020, https://taxfoundation.org/publications/funds-charge-recovery-throughout-the-oecd/. Calculations were current to reflect the 3 % buildings and properties allowance launched as element of the UK’s 2020 Finance Monthly bill. |

||||

The British isles rated 35th out of 36 nations around the world in the OECD on the expense restoration portion of our 2020 Global Tax Competitiveness Index. That part includes funds allowances, as properly as the tax treatment method of losses, inventory fees, and equity, generating it a composite evaluate of how professional-financial commitment a country’s company tax foundation is.

Although the UK’s corporation tax charge is very competitive among the produced nations around the world, the United kingdom has a corporate tax foundation that is ripe for reform. The Uk could present immediate price restoration for all investments, letting businesses to deduct bills for new investments right away alternatively than relying on lengthy depreciation schedules to recoup only a portion of their costs in authentic phrases.

Was this web page valuable to you?

Thank You!

The Tax Foundation works challenging to supply insightful tax coverage examination. Our do the job is dependent on support from associates of the public like you. Would you look at contributing to our get the job done?

Lead to the Tax Foundation

Enable us know how we can much better serve you!

We do the job tough to make our analysis as useful as probable. Would you contemplate telling us a lot more about how we can do greater?