From tuition to takeaways, why China’s regulatory crackdown is proving unappetising for traders | Business enterprise Information

5 min readChina’s federal government has just provided investors with yet another reminder of why they ought to tread very carefully when putting cash into the place.

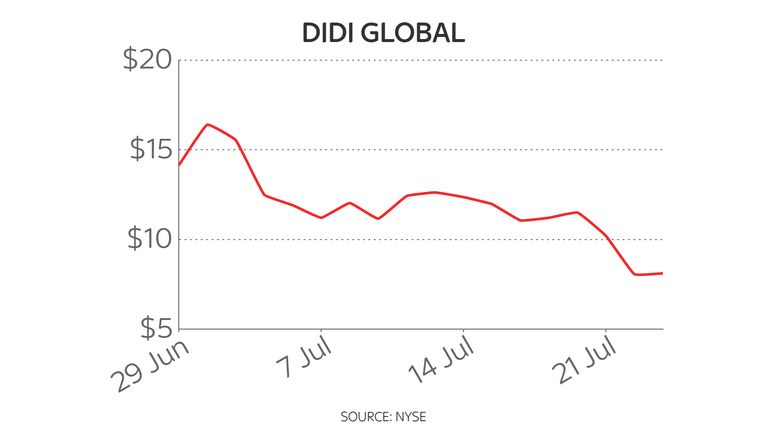

At the conclusion of final month, the Chinese journey-hailing app Didi created heritage when it floated on the New York Inventory Trade with a valuation of $70bn, building it the major IPO of a Chinese organization in seven a long time.

Just days later, the Chinese federal government told Didi to stop registering new drivers and consumers for its application, which it followed by demanding that Didi be taken off from Chinese application stores.

The shares plunged and are now 42% lower than the cost at which they outlined.

Now Beijing has carried out it once more with a clean salvo aimed at tech and instruction firms.

Firstly, the Chinese federal government introduced on Friday night time that it was banning non-public tutoring and check planning for core university subjects, arguing the shift would simplicity fiscal pressure on difficult-up Chinese families.

Personal tutoring in China is a $120billion-a-yr organization and close to a few-quarters of Chinese children are reckoned to have some form of non-public tuition outside school.

Beijing, which is anxious about the country’s rapidly-ageing population, suspects the financial force of educating small children privately might be a cause why couples are continue to not owning extra children irrespective of the abolition in 2015 of the “1 kid” policy.

The evaluate, which is considered to have appear from President Xi Jinping himself, was accompanied by restrictions on overseas expense in personal tutoring providers and is also expected to see promoting bans imposed – as properly as constraints on when tutoring can be manufactured available.

The shift sent shares of private tuition providers, several of which are shown in Hong Kong, tumbling.

New Oriental Education and learning & Technological know-how finished the session down 47%, although Scholar Training fell by 45% and Koolearn Engineering by 33%.

Following arrived an assault on Tencent, one particular of China’s most significant tech businesses, which on Saturday was requested to give up the unique new music licensing agreements it has signed with record firms – such as Universal Songs and Warner New music – around the environment.

Tencent, which owns China’s most well-known messaging services WeChat, is estimated to have an 80% share of the exceptional music streaming market place in the state.

Shares of Tencent fell by practically 8% on the information.

Then, Beijing unveiled actions aimed at cooling what it sees as an overheated house current market.

The People’s Financial institution of China (PBoC) is claimed to have purchased creditors to elevate home loan fees for 1st time prospective buyers from 4.65% to 5%.

At the exact same time, the PBoC is stated to have purchased an raise in the desire level for folks obtaining second properties from 5.25% to 5.7%. That sent shares in residence development organizations decrease.

Individually, China also currently declared new principles aimed at much better shielding shipping and delivery riders, pursuing complaints that some are not remaining compensated the minimal wage or are remaining despatched on routes wherever it is extremely hard to finish the buy in the time permitted.

That news sent shares of Meituan, one particular of China’s major meals shipping and delivery firms, down by 14%.

Its shares have now halved in benefit considering that February.

Shares of the e-commerce large Alibaba, which also operates a common supply support termed Ele.me, fell by more than 6%.

Taken alongside one another, the a variety of actions increase up to an unappetising cocktail for traders, who reacted accordingly.

In Hong Kong, the Hold Seng slid by 4.13%, getting it to a amount not seen considering the fact that December very last year.

In Shanghai, the blue-chip CSI300 index fell by 3.22%, once more wiping out all gains for the calendar year to day.

The broader Shanghai Composite, in the meantime, fell by 2.34% to a two-thirty day period low.

There are two colleges of thought as to what Beijing is performing listed here.

One particular is that this is just component of a broader marketing campaign by the Chinese Communist Party to reassert its affect above lifetime in China and bolster its hand – with businesses and traders merely becoming caught up in this.

The other argues that this is a certain established of actions aimed at clipping the wings of corporations amid considerations that way too several of them are not normally running in the legislation.

Aside from problems about the cure of workers in supply firms, there is also a sense that the accounting practices of some house corporations numerous not stand up to scrutiny, that the banks are becoming way too lax with their lending standards and that the prosperity remaining designed by some of these businesses, specially these in the tech sector, are being as well concentrated amid a handful of plutocrats.

That principle is presented credence by, for case in point, the way Beijing scuppered final year’s proposed stock market place flotation of the payments corporation Ant Financial, which would have even more added to the wealth of Jack Ma, the billionaire entrepreneur that made Ant and its previous dad or mum enterprise, Alibaba.

Issues about the high-quality of accounting at some firms have been rumbling ever considering the fact that a previous inventory sector darling, the espresso shop operator Luckin Coffee, collapsed final yr just after falsifying its accounts.

Both way, investors have been spooked, even though some will have only themselves to blame specified the way regulatory threat in China has been disregarded in modern decades.

But it has certainly prompted investors in China to glimpse a lot more closely at their portfolios as they consider to assess what other corporations are at chance of looking at their small business products minimized to rubble overnight by regulators.

Rightly so.

This Chinese governing administration is quite unique from its speedy predecessors and is plainly significantly a lot more peaceful about alienating international buyers if it considers much more critical principles are at stake.