David Chaston finds that firms are not investing a lot more, despite history small desire premiums, history very low organization tax rates, and governments that win extended steady terms

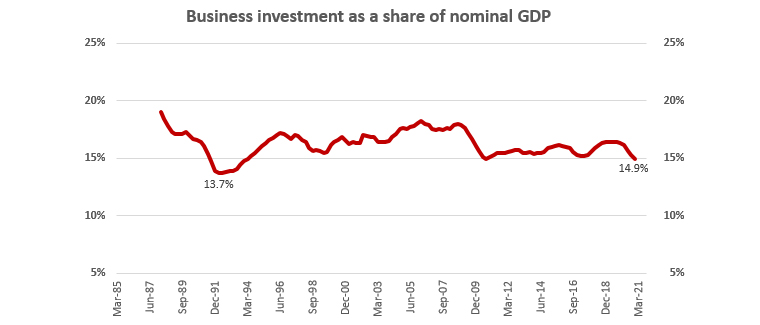

4 min readProvided 2020 was twisted with COVID, most likely it is no shock that business investment decision sunk to its least expensive amount because 1991, virtually a 30 yr small.

But then again, a closer search at the facts reveals it has been hovering at a reduced amount since 2010, by no means obtaining recovered due to the fact the Worldwide Fiscal Crisis.

The funk isn’t really of true financial commitment levels, but it is as a proportion of GDP.

But even in true expense ranges the the latest story is not that encouraging. In the 2018 calendar 12 months, $49.7 billion of company investment was added. In 2019 it rose to $52.1 billion. But in 2020 it sank to $48. billion.

Connected to financial output, the new peak was in 2006 when it topped 18.3% of GDP. Now it is underneath 15%. In the 14 decades because 2006, that is a enormous $75 billion in “underneath expenditure” by firms around that period of time, or much more than $5 billion per yr.

So the problem is, why the raising reluctance to commit?

A quick check of the chart reveals that in an previously era, investment decision costs approached 20%. We have never ever acquired anyplace in close proximity to that given that.

We can overlay two basic probable things and make some assessments about their impacts.

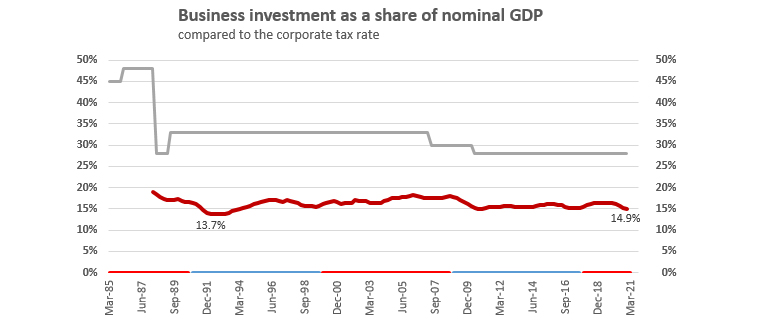

Tax costs

Lowering significant corporation tax premiums is an notion that is promoted as a way to enhance non-public sector financial investment. But does the facts display that?

In fact, it does at some degree. In the 1980s (of Muldoonism), organization tax fees have been extremely significant as element of a substantial-tax coverage vital because we had a closed economy in which we have been defending a fastened exchange rate, just one established by the autocratic primary minister. We also had superior unemployment, which essential make-operate schemes as a result of forcing Authorities departments to seek the services of the jobless to continue to keep them off the unemployment rolls. It was unsustainable, and ultimately collapsed. Business “investment decision” was twisted into jobs that only made sense in a closed economic climate. But even in this natural environment, private sector business expense fell sharply from about 20% of GDP to 14% in just 4 several years.

But then the reforming Lange Govt reduced the 48% business tax amount to 33%, and investment decision degrees started off to pick up yet again, even if they failed to return to the degrees in the closed overall economy.

However, the following lower in organization tax charges did not produce a rise in private sector expense. The company amount charge was minimized from 33% to 28% in 2010 and the information reveals that the increasing actual expenditure hardly saved rate with the enlargement of the all round financial system (as measured by GDP). A 28% corporation tax charge did not crank out any more investment decision that a 33% amount.

Probably this must not be surprising. Organization are not likely to decide on to force ahead with a venture in which a 5% net cash flow variation is the enthusiasm to continue or not. If it is that close, it is ordinarily not worth having the risk. So a modified tax price that compact won’t be a selecting issue.

Desire costs

Interestingly, similar tiny variances are typically concerned with curiosity rate changes, and these far too will not motivate a ‘go’ financial investment decision in excess of a ‘no go’ a person.

Political coverage

A more influential aspect is the security of political plan. Unanticipated variations and the expectation of future undefined improvements in community policy, is in no way a great basis for creating medium or lengthy expression investment decision conclusions. That is genuine irrespective of whether they are supportive or not. And that is for the reason that ‘supportive’ adjustments can get altered out at the future election.

New Zealand has been fortuitous that, despite the 3-yr phrases of governments, the voters have mainly offered nine 12 months conditions about the past 35 a long time. And nine yrs is ‘stability’ for any professional selection. Sad to say, the altering character of coalitions undermines that.

It is apparent from the charts over that regardless of whether the Governing administration is ‘red’ or ‘blue’, it has really minimal effects on regardless of whether companies commit or not. Of class, this may well be since centrist Governments anxious to get re-elected and thorough not to make transformative changes that could damage in the brief phrase, can under no circumstances change policy options enough and on a sustained foundation that will enhance the prolonged expression expense outlook. Even right now, most industries wrestle with halt-go and opaque Federal government guidelines, unconvinced undermining surprises are not about to unstitch a brave financial investment determination. We are trapped in short-termism.

One particular consequence is that company financial investment as a share of economic activity is now at its most affordable amount in a lot more than a technology.

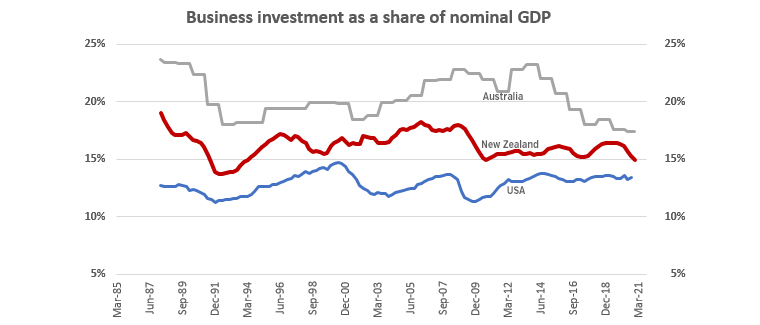

Global perspective

New Zealand has its problems. But we are not alone in that, as this comparison exhibits. Absolutely, even Trump’s substantial corporate tax cuts in 2016 and application of regulatory rollbacks did not energise financial commitment in the United states of america.

New Zealand info has been sourced from Stats NZ (with particular thanks for their aid with that). US information is below. Australian facts is below. (Australian expense has an outsized ingredient similar to mining for their China trade.)