Critical Symptoms: a bounce-again in investment retains open the likelihood of pretty very good information

3 min readNon-public business financial investment is 1 of the vital motorists of economic development.

Business enterprise investment in tools (and even in buildings) drives productiveness, which the Nobel Prize winning economist Paul Krugman famously noticed

isn’t everything, but in the very long run it is nearly almost everything

As he set it, a country’s skill to make improvements to its common of living around time “depends nearly completely on its capability to raise its output per worker”.

Which is why one particular of the forecasts in this month’s funds stood out.

The spending plan forecast non-mining enterprise expenditure to improve 1.5% in the coming 2021-22 economic 12 months, following falling final year and then to jump a enormous 12.5% for the duration of 2022-23.

Thursday’s funds expenditure figures unveiled by the Bureau of Statistics are crucial not only since they inform us what personal companies have been paying out on plant and tools and buildings and constructions, but also what they are preparing to invest in the months and yrs forward.

The study that details to the foreseeable future

Economists like me are very sceptical of surveys.

We like to see what men and women basically do (so-termed “revealed preference”), somewhat than what they say they intend to do (“stated preference”).

But the bureau has a respectable track history with this study. In section that’s since the men and women surveyed are the chief fiscal officers of the major firms. They are inclined to report what they know is in prepare rather than “spin” grander visions.

And they commonly understate what finally transpires.

Examine extra: Spending plan 2021: the floppy-V-formed restoration

On what has in fact happened, their reviews recommend that private non-mining company expense bounced again 7.1% in the 1st a few months of this calendar year.

In the six months to March (due to the fact September) it jumped 13.8%, after slipping 11.4% in the prior 6 months of COVID limits top up to September.

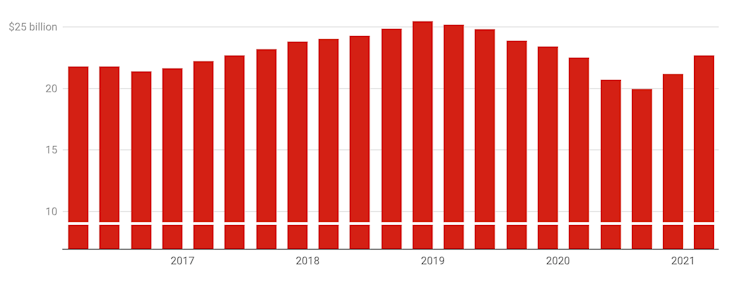

Quarterly non-mining non-public capital expenditure

Impression: Ab muscles Personal New Funds Expenditure and Anticipated Expenditure, Australia

When it arrives to what lies in advance, the estimates for 2021-22 are choosing up.

The March estimate is up 11.3% from the estimate made in December.

It is however effectively down on the latest estimate for 2020-21, about 13% down. But real non-mining expense is usually somewhere between 30% and 50% better than what’s envisioned (the bureau calculates “realisation ratios”) this means there’s a great probability it will fulfill the finances forecast for 2021-22.

Browse much more: Essential Signs: wages advancement desultory, unemployment breathtaking

Whether or not it will make it about the substantially more substantial bar of the 12.5% maximize forecast for 2022-23 is an open up issue.

The point is, the figures revealed on Thursday give us no rationale for wondering it could not. The Bureau of Studies has remaining open up the probability of quite fantastic information.

The bounce-back in investment exceeds sector expectations.

Superior, and improved than expected

JP Morgan studies that the consensus of forecasts was for an overall increase in financial investment (mining and non-mining) of 2% in the March quarter. We got 6.3%.

It issues for the reason that it tells us firms are feeling optimistic about the foreseeable future — optimistic sufficient to broaden, notwithstanding everpresent uncertainties.

We really don’t know when our intercontinental borders will reopen. We never know how prolonged Melbourne’s latest lockdown will final. We really do not know no matter whether ample Australians will be vaccinated to achieve herd immunity.

Read more: Exclusive. Leading economists again budget force for an unemployment fee starting with ‘4’

And the success also make any difference for the reason that a lot more company investment decision will be desired if we are to push unemployment down to the government’s new (and welcome) goal of somewhere beneath 5%.

The further work will have to appear from enterprises employing extra men and women. They will not do it except they imagine it is worthwhile to commit.

Richard Holden, Professor of Economics, UNSW

This posting is republished from The Conversation under a Creative Commons license. Read through the authentic report.