COVID-19: Moonpig doubles once-a-year earnings and income many thanks to lockdowns | Organization News

2 min readMoonpig, the on line greeting card and reward retailer, has reported a doubling of annual profits and earnings as lockdown limitations on purchasers boosted need.

Even though higher avenue rivals ended up forced into hibernation owing to the COVID-19 crisis, the enterprise benefited from just about 51 million transactions as prospects flocked to mark birthdays and other milestones.

Moonpig stated its outcomes – the first considering the fact that a profitable stock industry debut in February – reflected investment in on the net companies like its application.

It reported revenue of £368.2m over the 12 months to the finish of April, up 113% on the previous year, and adjusted core earnings of £92.1m – 107% larger.

Pre-tax profits were being just 3% up at £32.9m – mainly a outcome of one-off costs associated with the flotation.

Main executive Nickyl Raithatha stated of the general performance: “In the earlier 12 months we have delivered an enduring transformation and move-transform in the scale of our enterprise.

“The very long-term development option stays vast, with the the greater part of the card and gifting sector nevertheless offline, and we have in no way been in a improved position to capture this development.”

Moonpig upgraded expectations for its existing economical yr but claimed it predicted group earnings to be about £250m to £260m – down by more than £100m.

The firm explained of the pandemic’s effect: “As constraints have eased, we have observed consumer acquire frequency get started to normalise from elevated degrees, and we expect this to carry on in line with past anticipations.

“Even with this buying and selling headwind, and the annualisation of the substantial cohort of new prospects obtained through lockdown, we now be expecting profits to be between 45% to 50% greater than in (pre-pandemic) FY20.”

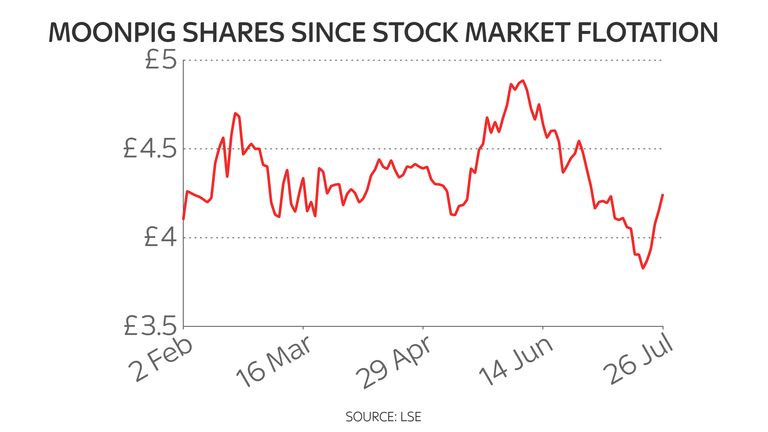

Shares, which ended up stated at an supply value of 350 pence, ended up investing 3.5% bigger at 439p in early investing on Tuesday but later on slipped sharply, slipping as much as 8%.

Market place analysts claimed it mirrored ongoing significant advertising and marketing commit and, in specific, the predicted slide in profits.

Zoe Mills, senior retail analyst at GlobalData, said: ” This is to be expected as some consumers revert back again to bricks-and-mortar players.

“Features these types of as reminders, of which 50 million ended up established as of 30 April 2021, will assistance purchaser retention and Moonpig have to proceed to spend in both of those its cellular app and website to even more increase advantage.

“Moonpig’s long term appears to be promising, with robust financial commitment and the pandemic performing as a tailwind for its achievements,” she concluded.