COVID-19 is no lengthier the greatest stress for monetary markets – so what is? | Organization Information

6 min readFor the 1st time in much more than a year, fund managers do not see COVID-19 as the largest chance for international marketplaces to grapple with.

That is the eye-catching getting of the most recent regular monthly survey of fund administrators carried out by the expenditure banking arm of Lender of The united states (BoA).

Every month, because February very last 12 months, people taking part in this influential study have pinpointed coronavirus as the amount a person problem.

The latest study, executed between marketplace industry experts running $597bn (£430bn) worthy of of funds, has it as only the third greatest worry.

As a substitute, weighing additional greatly on the minds of traders is bigger-than-predicted inflation, determined as the biggest single issue by 37% of those people polled.

This is perhaps comprehensible. Joe Biden has just signed into law a $1.9trn stimulus package deal as he seeks to boost development in the US economic climate as it emerges from the pandemic.

This is on top of the $900bn stimulus package deal that the Trump administration unveiled in its dying days.

It has raised fears that the US financial system, which contracted through the pandemic by a lot less than that of Japan or of significant European economies these types of as Germany, the Uk and France, may possibly above-heat – with the offer of products and solutions failing to hold up with need.

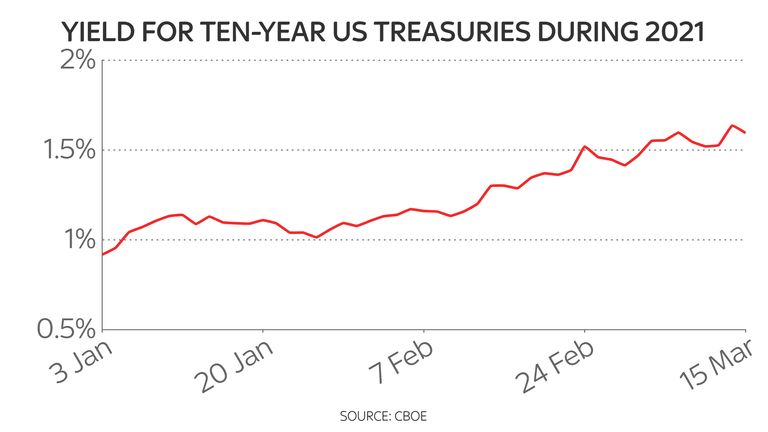

This was the rationale for the modern offer-off in US governing administration bonds, or Treasuries, as inflation is the enemy of set-earnings securities.

The yield – which rises as the cost falls – on 10-year US Treasuries hit 1.642% on Friday previous week, its maximum level considering that February very last year and predating the pandemic, getting stood at .912% at the commencing of the yr.

That is a significant soar. To set it in context, the produce on 10-12 months United kingdom govt gilts presently stands at .781%, though the produce on 10-calendar year Japanese government bonds, JGBs, is currently .1%.

The generate on 10-12 months Bunds, German government bonds, is at this time -.344% – in other terms, continuing an recognized pattern in current decades of buyers essentially having to pay the German authorities for the appropriate to lend to it.

So the rise in US Treasury yields highlights the extent to which investors are demanding a premium for lending to Uncle Sam.

That is not of by itself a worry to the US authorities when the US Federal Reserve is purchasing in $120bn worthy of of assets each and every thirty day period – a superior deal of that in the form of US Treasuries – as it proceeds with Quantitative Easing (QE).

But the velocity with which the Fed could withdraw those purchases, if it suspects that the US economy is managing much too warm or if inflation is about to rear its hideous head, is the next most important trigger for problem pinpointed by fund supervisors in the BoA survey.

Fully 35% of all those polled saw a “taper tantrum” among investors as the up coming most important chance to markets. This is the time period which describes a offer-off in US Treasuries encouraged by the Fed withdrawing monetary stimulus.

The phenomenon was to start with witnessed in 2013 when, in response to indicators that the US financial state experienced fully recovered from the economical disaster, the Fed – then chaired by Ben Bernanke – indicated it would withdraw QE.

US Treasuries offered off aggressively, the US dollar rose and inventory markets in rising economies these as Brazil, South Africa, Turkey and Indonesia, all of which have substantial amounts of greenback-denominated personal debt, fell sharply as abroad investors withdrew their money.

In the event, the Fed did not really taper its bond purchases but alternatively, released yet another round of QE. These kinds of tantrums, or the risk of them, have manufactured it really difficult for the Fed to withdraw monetary stimulus.

Yet the present-day price tag of US Treasuries does not show up to be causing traders also substantially worry. Questioned what degree the produce on 10-year US Treasuries would have to access to spark a 10% correction in stocks, some 43% of those responding claimed 2%, suggesting we are not there however. But it is really worth viewing this certain protection intently in coming months and months.

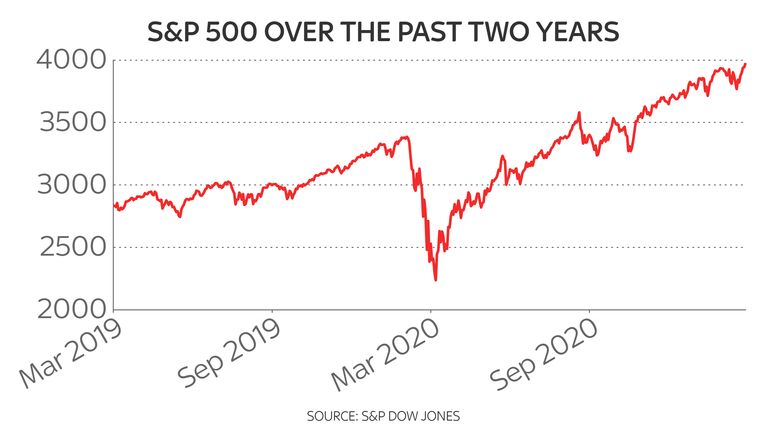

The other key takeaway from the BoA survey is that, notwithstanding volatility in US Treasuries, fund supervisors continue being incredibly bullish about inventory markets.

Some 48% of traders feel the world wide economic climate is taking pleasure in a so-referred to as “V-formed” recovery, in other words and phrases a straight bounce-back again from the pandemic, up from just 10% who anticipated this sort of an consequence in Could previous 12 months.

Fund professionals expect the toughness of that restoration to outcome in more powerful organization profits. A web 89% of fund professionals surveyed assume enterprise profits to mature – an even bigger percentage than in February 2002, when the US economic downturn sparked by the stop of the dot-com increase and the 9/11 terror attacks was coming to an finish or in December 2009, when it grew to become crystal clear that the world-wide overall economy had pulled clear of the recession sparked by the world-wide economical crisis.

Apparently, a majority of all those investors polled by BoA – some 52% – would prefer to see firms recycling those earnings into their small business by raising capital expenditure, instead than by returning it to shareholders via dividends and share buy-backs.

And investors are backing that optimism. A net 20% of investors said they had been adopting larger threat ranges than typical.

As striking is the locating that, inspite of the stunning general performance of US inventory markets during the previous 12 months, only 15% of investors regard the US as a bubble. Some 25% of these polled nonetheless assume this the early stages of a bull current market when 55% regard it as the late stage of a bull market. That might not apply to tech stocks, even though, with becoming “extended” of tech stocks regarded as the “most more than-crowded” trade.

The study also reveals that the so-termed “great rotation”, with traders switching away from expansion stocks like techs and into so-termed “price” shares (these stocks which surface to be investing at considerably less than their inherent value) is well underway. Appropriately, traders have been switching from the tech sector to industrial, banking and purchaser discretionary stocks.

All of this suggests that traders are quite constructive about the outlook.

Even so, the recent potent run in shares, specially in the US, has pushed stocks to historically significant stages.

The S&P 500, America’s broadest stock index, is at present trading at 22 moments predicted earnings for the following yr – in comparison with a extended-expression average of 16 periods. Other major inventory indices, this kind of as the Topix in Japan and the pan-European Stoxx 600 are similarly trading at a top quality to their long expression common.

That implies there is loads of scope for disappointment if organization earnings fall short to come up to snuff.

There are also a good deal of other indicators of irrational exuberance out there, irrespective of whether that is the current mania for cryptocurrencies or the rush to start Special Function Acquisition Organizations (SPACs), otherwise acknowledged as so-referred to as “blank cheque” organizations.

It is an previous expenditure stock market adage that markets climb a “wall of worry”.

There is certainly loads of optimism right now among investors. There are also a lot of motives to be nervous.