COVID-19: FTSE 100 plunges as latest pandemic fears overshadow ‘Freedom Day’ | Enterprise News

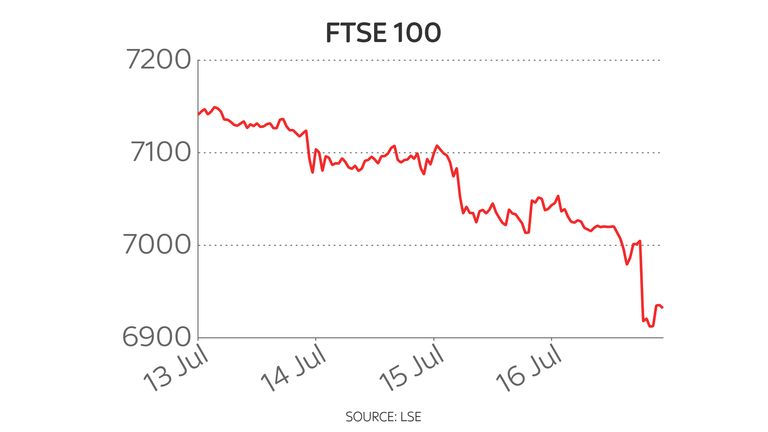

The FTSE 100 has fallen sharply as the easing of lockdown limits in England unsuccessful to assuage increasing fears about COVID scenario quantities and disruption.

US and European indices joined London’s leading share index in plunging at Monday’s open.

The FTSE 100 was 2.6% or 188 factors decreased by 3pm – led by falls of extra than 6% for British Airways owner Worldwide Airways Group (IAG) and ITV.

Firms from plane motor maker Rolls-Royce and Holiday Inn to Crowne Plaza owner Intercontinental Lodges Group and Whitbread, owner of Leading Inn, had been also among the worst hit.

There were being no stocks in the risers’ column as the FTSE joined the world-wide market-off which noticed very similar declines on European bourses and followed falls overnight in Asia.

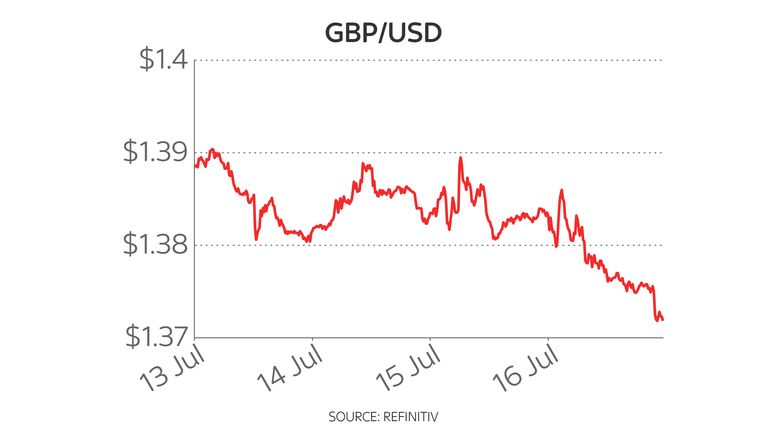

In the meantime the pound dipped by extra than fifty percent a cent versus the US greenback to just about $1.37, its least expensive degree in a few months.

Analysts have pointed to climbing cases globally as well as increasing fears about escalating inflation as staying powering the most current cautious switch for buyers.

Susannah Streeter, senior investment and marketplaces analyst at Hargreaves Lansdown, said of the plunge: “Much from giving buyers a jolt of confidence, Liberty Working day has noticed it evaporate, as sharply rising an infection fees disrupt organizations across the United kingdom.

“From retail to producing and hospitality, the warnings are coming thick and quick that obligatory isolation is main to reduced business operating hours, a drag on product sales and a reduction of output.

“Amidst concerns that soaring an infection prices could derail the recovery are concerns about inflation heating up, and the knock on impact of rising interest costs combined with the roll back of mass bond shopping for programmes.”

In the United kingdom, hopes for another leap back to normality for the financial state as social distancing and mask sporting policies are abolished have been undercut by a resurgence in conditions and warnings to the public to remain careful.

Companies are progressively sensation the influence of huge numbers of employees being absent mainly because they are forced to self-isolate after staying alerted by the COVID-19 app.

In the travel sector, fading hopes for holiday getaway revenue were being dealt a even further blow around the weekend as Britons returning from France were instructed they will nonetheless have to quarantine even if they are thoroughly vaccinated.

Michael Hewson, market place analyst at CMC Markets, stated: “There was a terrific deal of optimism above the summer season reopening, but as we appear at how Delta variant infections are soaring, some of that optimism is dissipating.”

Britain’s currency is in focus as investors look at for the end result of restrictions getting eased even as instances are soaring.

“The planet will be viewing the United kingdom experiment with big interest,” Deutsche Bank strategist Jim Reid mentioned in a notice to customers.

“It could demonstrate a pathway back again to normality or it could be a warning to even closely vaccinated international locations that COVID will be a dilemma for a first rate length of time continue to.”