Could The Beijing Gas Blue Sky Holdings Restricted (HKG:6828) Possession Construction Tell Us Something Beneficial?

5 min readThe major shareholder groups in Beijing Gasoline Blue Sky Holdings Restricted (HKG:6828) have electricity over the corporation. Institutions typically personal shares in far more established companies, although it is really not uncommon to see insiders possess a truthful little bit of scaled-down companies. Warren Buffett claimed that he likes “a enterprise with enduring competitive pros that is operate by in a position and proprietor-oriented men and women.” So it can be wonderful to see some insider ownership, since it may well counsel that administration is proprietor-oriented.

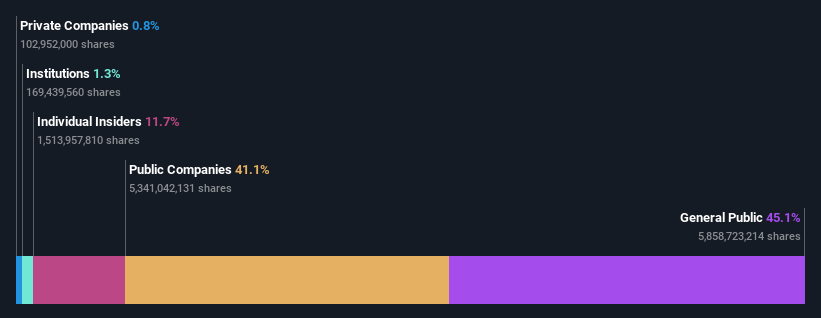

With a marketplace capitalization of HK$1.5b, Beijing Gasoline Blue Sky Holdings is a little cap stock, so it may well not be very well identified by a lot of institutional investors. In the chart below, we can see that institutions are not definitely that prevalent on the share registry. Let us delve deeper into each sort of operator, to learn additional about Beijing Gas Blue Sky Holdings.

Check out our newest assessment for Beijing Gasoline Blue Sky Holdings

What Does The Institutional Ownership Inform Us About Beijing Gasoline Blue Sky Holdings?

Establishments generally evaluate themselves in opposition to a benchmark when reporting to their own traders, so they generally come to be far more enthusiastic about a stock as soon as it really is integrated in a big index. We would hope most corporations to have some institutions on the sign-up, specifically if they are escalating.

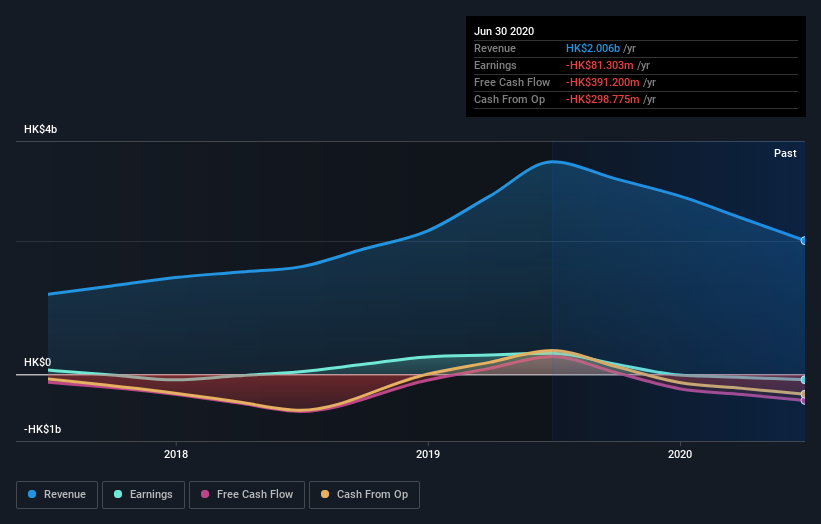

Institutions have a pretty little stake in Beijing Fuel Blue Sky Holdings. That implies that the organization is on the radar of some funds, but it just isn’t especially well-known with specialist buyers at the moment. If the small business will get stronger from listed here, we could see a predicament the place much more establishments are eager to buy. It is not unheard of to see a huge share price tag increase if many institutional buyers are making an attempt to acquire into a inventory at the exact time. So look at out the historic earnings trajectory, down below, but retain in head it is the long run that counts most.

We notice that hedge funds will not have a significant expense in Beijing Gasoline Blue Sky Holdings. Beijing Enterprises Holdings Constrained is presently the firm’s major shareholder with 41% of shares exceptional. With 6.% and 5.3% of the shares excellent respectively, Tsz Dangle Lee and Ming Kit Cheng are the 2nd and 3rd greatest shareholders. Ming Package Cheng, who is the 3rd-largest shareholder, also happens to keep the title of Vice Chairman.

A a lot more in-depth research of the shareholder registry confirmed us that 3 of the top shareholders have a sizeable total of ownership in the business, by means of their 52% stake.

Exploring institutional ownership is a superior way to gauge and filter a stock’s anticipated functionality. The same can be realized by studying analyst sentiments. We are not picking up on any analyst protection of the stock at the moment, so the enterprise is unlikely to be extensively held.

Insider Ownership Of Beijing Gasoline Blue Sky Holdings

The definition of an insider can differ a little bit involving different international locations, but associates of the board of administrators usually count. Management in the long run answers to the board. However, it is not unusual for supervisors to be executive board associates, in particular if they are a founder or the CEO.

Most take into consideration insider ownership a positive mainly because it can suggest the board is perfectly aligned with other shareholders. However, on some occasions also significantly energy is concentrated in this group.

It seems insiders individual a sizeable proportion of Beijing Gasoline Blue Sky Holdings Confined. Insiders very own HK$176m worth of shares in the HK$1.5b business. I would say this shows alignment with shareholders, but it is truly worth noting that the enterprise is still quite modest some insiders may well have launched the company. You can simply click here to see if individuals insiders have been obtaining or advertising.

Normal Public Ownership

The common general public retains a 45% stake in Beijing Fuel Blue Sky Holdings. When this dimensions of ownership may perhaps not be enough to sway a plan decision in their favour, they can however make a collective affect on firm policies.

General public Corporation Possession

It seems to us that general public businesses personal 41% of Beijing Fuel Blue Sky Holdings. It can be challenging to say for certain but this indicates they have entwined business enterprise passions. This might be a strategic stake, so it is well worth looking at this space for alterations in possession.

Subsequent Techniques:

Even though it is nicely really worth thinking of the unique teams that possess a organization, there are other components that are even additional essential. Be aware that Beijing Fuel Blue Sky Holdings is exhibiting 2 warning signals in our financial investment investigation , and 1 of those shouldn’t be overlooked…

Of class this may not be the finest stock to buy. Consequently, you may perhaps would like to see our totally free assortment of intriguing potential customers boasting favorable financials.

NB: Figures in this post are calculated applying details from the final twelve months, which refer to the 12-thirty day period period of time ending on the final date of the month the economical statement is dated. This may not be regular with full yr once-a-year report figures.

Promoted

If you’re hunting for shares to obtain, use the lowest-charge* platform that is rated #1 All round by Barron’s, Interactive Brokers. Trade stocks, choices, futures, foreign exchange, bonds and money on 135 markets, all from a solitary built-in account.

This write-up by Basically Wall St is common in character. It does not represent a suggestion to invest in or sell any inventory, and does not choose account of your targets, or your economical scenario. We intention to provide you prolonged-term centered assessment pushed by basic facts. Note that our examination may well not component in the most recent price tag-delicate enterprise bulletins or qualitative substance. Basically Wall St has no posture in any shares mentioned.

*Interactive Brokers Rated Least expensive Value Broker by StockBrokers.com Annual On the net Overview 2020

Have suggestions on this article? Concerned about the information? Get in touch with us specifically. Alternatively, electronic mail editorial-group (at) simplywallst.com.