‘Buy now pay out later’ corporations facial area FCA crackdown after Woolard assessment | Enterprise News

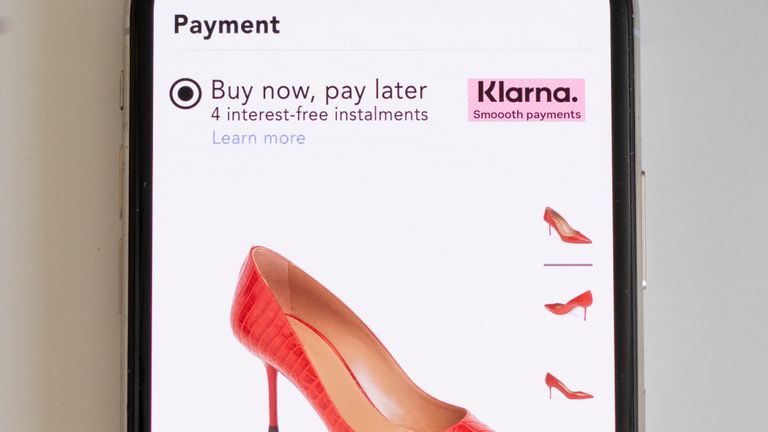

2 min read‘Buy now, pay later’ corporations these types of as Klarna will deal with tighter regulation from the City watchdog following a assessment of the unsecured credit history industry.

Sky Information has learnt a report to be posted on Tuesday by the former Money Conduct Authority (FCA) interim chief govt Chris Woolard will advise that the sector be formally brought under the regulator’s scrutiny.

The advice will occur a lot more than 4 months right after Mr Woolard was commissioned by the FCA board to undertake the critique, amid concerns in excess of the amount of purchasers purchasing products and solutions that they were unable to pay for.

His critique is understood to simply call for an growth of the FCA’s regulatory perimeter to encompass organizations these as Klarna and Clearpay, which have witnessed their shopper numbers surge in the course of the pandemic.

The acquire now, fork out later on (BNPL) sector has confronted escalating criticism of the approach it can take to individuals who drop behind with repayments, with the coronavirus crisis substantially exacerbating the dilemma.

Though BNPL corporations do not on their own supply direct credit score facilities to customers, considerations have risen about their promptly increasing scale.

The Treasury is recognized to be supportive of Mr Woolard’s vital suggestion to bring the sector in just the FCA’s regulatory remit.

The FCA declined to remark, but a spokesman for Klarna claimed that as a licensed bank, it was “very at ease functioning in a controlled environment and wholeheartedly supports even more regulation of the acquire now pay afterwards sector in the British isles”.

“We concur that regulation has not saved speed with new solutions and changes in shopper behaviour and it is now crucial that regulation is modern-day and in good shape for objective, reflecting both the electronic mother nature of transactions and evolving purchaser choices.”

Klarna has come to be 1 of the world’s most important fintech firms, and is expected to float on a general public exchange in the subsequent few of several years.