Blackstone, KKR: New Financial investment in Industrial Serious Estate Starts With Science

4 min readEven as the remote-perform period clouds the long term for offices, one phase of the small business is drawing funds from traders including Blackstone Group Inc. and KKR & Co.

Extra than $10 billion has absent toward buying buildings utilized for lifestyle sciences and other research this 12 months, according to Actual Funds Analytics Inc. That accounted for approximately 4% of all world-wide industrial genuine estate transactions through Might, double the share from past 12 months.

That estimate does not count new development, and fresh new properties are breaking floor in U.S. cities like Boston, San Diego and San Francisco — numerous without having having signed major tenants. Not like personnel in regular offices, quite a few experts really don’t perform remotely. And as vaccines help gasoline the financial rebound, funding for professional medical improvements is anticipated to travel the need for additional place, significantly in the U.S. and U.K.

“The pandemic only amplified the need development, but it is a development we think will proceed for years,” Nadeem Meghji, Blackstone’s head of actual estate Americas, explained in an interview. “This is about, broadly, improvements in drug discovery, improvements in biology and a increased want presented an getting older inhabitants.”

Last 12 months, as social-distancing emptied out office environment properties and damped trader desire in malls and accommodations, lifestyle science building revenue and refinancing totaled about $25 billion, up from about $9 billion in 2019, according to Eastdil Secured. Blackstone, a veteran investor in the sector, booked a $6.5 billion profit from refinancing BioMed Realty Trust, the major personal operator of existence-science office environment properties in the U.S. It also agreed in December to buy a portfolio of lab properties for $3.4 billion.

KKR compensated about $1.1 billion in March for a San Francisco business complicated it strategies to repurpose for daily life science tenants. DropBox Inc. had rented the whole web-site in 2017, but broke its lease so workforce could work remotely. In a person significant-profile U.K. illustration, a science campus is planned for a Canary Wharf web site as soon as slated as the London headquarters for Deutsche Financial institution AG. Total, the U.K. lifetime sciences market saw a 166% maximize in the quantity of transactions in the final a few a long time, in accordance to serious-estate services agency Jones Lang LaSalle Inc.

Persons chill out in Greenwich Park in perspective of the Canary Wharf enterprise, purchasing and financial district in London.

Photographer: Jason Alden/Bloomberg

Even prior to the pandemic, everyday living science house was on the upswing. Over the very last five years, inquiring rents for this sort of space soared 90% in the San Francisco Bay Region in comparison with 20% for regular office environment space, according to professional property brokerage Newmark. In Boston, which together with nearby Cambridge is an epicenter of the sector in the U.S., asking rents climbed three moments as rapidly.

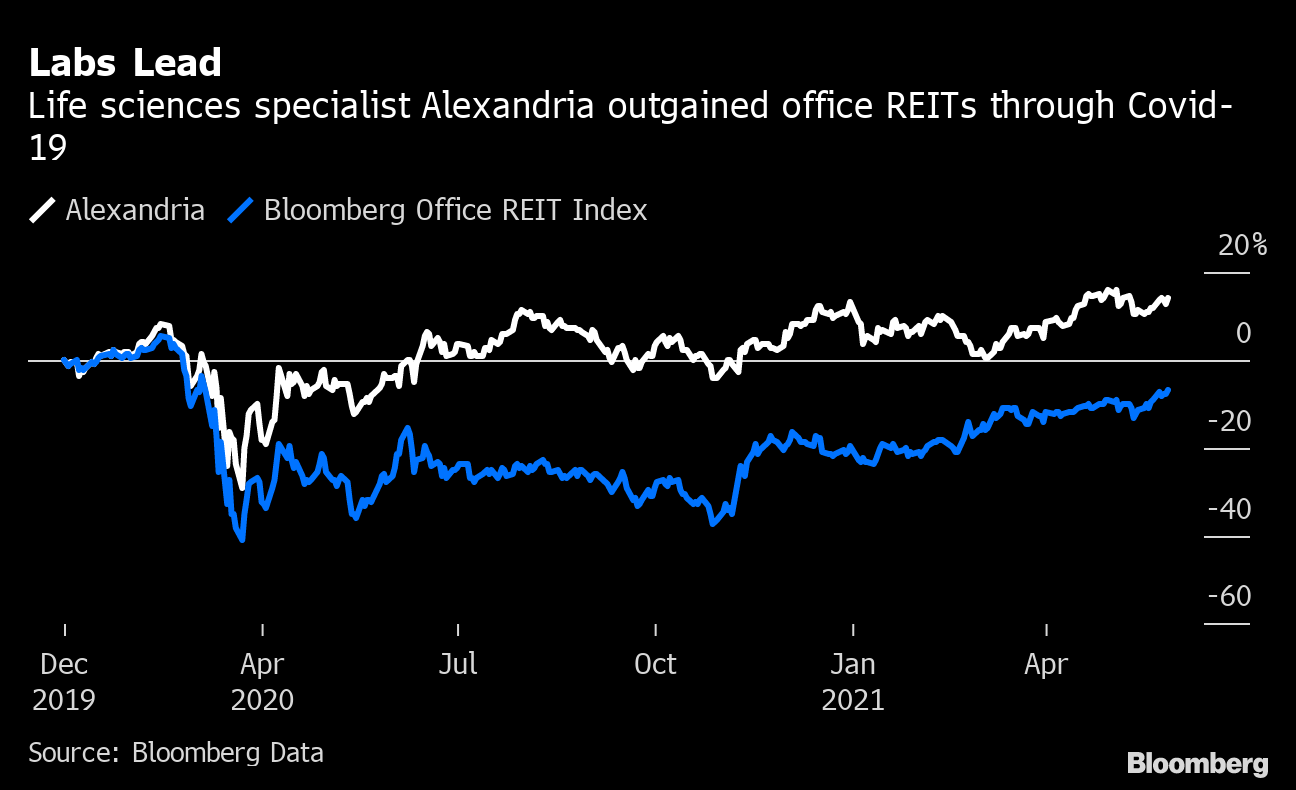

Labs Lead

Lifetime sciences specialist Alexandria outgained place of work REITs through Covid-19

Source: Bloomberg Details

Traders see the higher rents translating into bigger assets values, which explains why development jobs are shifting forward without tenants lined up. Among the most significant spec builders is IQHQ, a startup that elevated $2.6 billion final yr to develop laboratory properties that are breaking ground without having signed leases. In April, the firm launched building of Fenway Middle, a $1 billion complex on a system previously mentioned Boston’s Interstate 90 with a rooftop view of the famed Red Sox ballpark. The organization isn’t anxious about filling up the place, according President Tracy Murphy.

“We make spec, but we really don’t develop blind,” Murphy explained in an job interview from San Diego, in which her company is pouring concrete for a 1.6 million-square-foot waterfront lab sophisticated. “I really do not see any stop in sight for funds coming in.”

Fenway Middle is $1 billion two-tower task near Boston Crimson Sox Fenway Park

Source: IQHQ

Harrison Avenue, a Chicago-dependent substitute serious asset trader, has about $2.6 billion invested in lab homes and needs to double that around the upcoming 24 months, Chief Govt Officer Christopher Merrill stated in an job interview. Alexandria Real Estate Equities Inc., the greatest life sciences real estate expense belief, also has large expansion designs.

In January, it paid $1.5 billion for a task in Boston’s Fenway community. The corporation has 4 million square toes of space under design — about 1 million of which however has not been leased.

RaDD (Investigate and Development District) is a 1.6 million-sq.-foot San Diego waterfront five-developing venture, which broke floor in 2020.

Resource: IQHQ

As traders clamor to break floor, there’s a risk of an oversupply of place, reported Jeffrey Langbaum, an analyst with Bloomberg Intelligence. Another hazard for developers is that lab area construction can price as significantly as 15% far more than traditional offices. Science buildings demand more robust structures and bigger ceilings to accommodate options these types of as increased air filtration. That limitations likely other employs for the house if health and fitness-field tenants really do not materialize.

Lab buildings are investing for capitalization costs, a measure of returns for investors, of significantly less than 4%, which is decrease than apartment properties or industrial homes. There’s been cap amount “compression” around the very last yr amid a surge in investor capital flowing into the sector, according to Sarah Lagosh, running director in the Boston place of work of Eastdil.

The recovery of common workplaces is predicted to take time as organizations connect with workforce back around the up coming few months. Even then, lots of corporations have claimed they’ll let persons keep residence at the very least section of the time. That’s elevated issues about the potential of downtown skyscrapers, when Covid-19 has added to the momentum for lifestyle sciences homes.

“The pandemic has pushed life sciences into warp pace,” explained Jonathan Varholak, who runs the existence sciences team in the Boston workplace of the serious estate organization CBRE. “You can not do chemistry from property.”