Bitcoin: Number of Uk grown ups with cryptoassets rises to 2.3 million | Organization Information

3 min readAn believed 2.3 million Uk older people now maintain cryptoassets this kind of as Bitcoin – despite warnings of the dangers associated – according to the Town watchdog.

The determine from the Fiscal Carry out Authority (FCA) represents a increase of 400,000 since past 12 months.

It is dependent on a survey of additional than 2,000 individuals taken in January which also advised that the stage of overall understanding of cryptocurrencies was declining.

Most users tended to be gentlemen aged about 35 in the “AB” social grade masking administrators and industry experts, the FCA explained.

They usually maintain all around £300 – up from £260 earlier – though 14% claimed they experienced borrowed to make investments and 18% reported they did so owing to panic of lacking out.

The examine also identified less crypto people regard the tokens as a gamble – 38%, down from 47% previous calendar year – though growing numbers see them as possibly a enhance or an alternate to mainstream investing.

It also instructed enthusiasm for the assets escalating, with much more than 50 percent of end users reporting a positive working experience so much and less regretting getting acquired cryptoassets.

The FCA investigate arrived at a time of heightened desire in the sector and a increase in the price, as well as effectively as much more widespread involvement of economic companies corporations and institutional financial commitment in the marketplace.

The watchdog claimed that it experienced issued a range of warnings about the dangers included.

Sheldon Mills, the FCA’s government director for consumers and level of competition, stated: “The marketplace has continued to improve, and some buyers have benefitted as rates have risen.

“However it is essential for buyers to recognize that mainly because these goods are mainly unregulated that if anything goes improper they are not likely to have access to the FSCS [Financial Services Compensation Scheme] or the Economic Ombudsman Service.

“If customers commit in these kinds of items, they should be well prepared to shed all their cash.”

The most popular kind of asset was Bitcoin, held by 66% of consumers, followed by Ethereum at 35%, according to the survey.

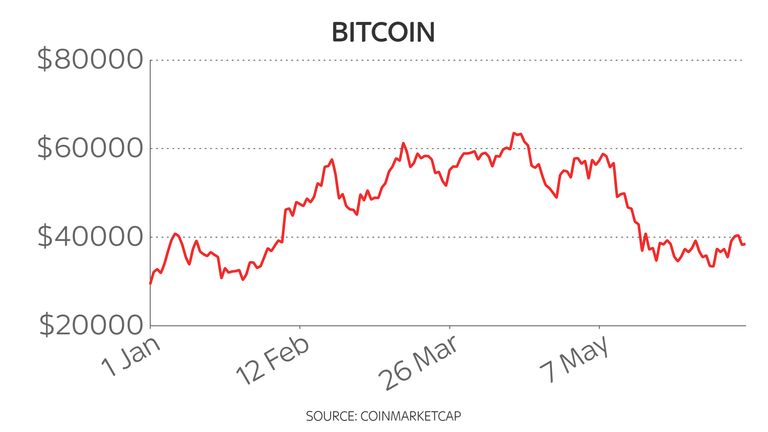

Bitcoin hit a history superior of $65,000 (£47,000) in April but has due to the fact been strike by fears of a crackdown on the sector in China, as properly as Tesla boss Elon Musk’s reversal of a choice to make it possible for the electric powered automobile maker to settle for payments in the cryptocurrency.

That prompted a sharp slide to about $30,000 (£21,180), nevertheless it has since partly recovered.

Bank of England governor Andrew Bailey has earlier expressed worries about cryptocurrencies, also stating men and women must only devote in them if they are prepared to reduce all their cash.

Very last 7 days, El Salvador became the initially nation to approve of the use of Bitcoin as legal tender.

Laith Khalaf, money analyst at AJ Bell, reported the FCA exploration “paints a broadly optimistic photograph and exhibits most customers are working with crypto sensibly and moderately”.

“However, there is a dim underbelly lurking in the figures, which suggests there is continue to prospective for prevalent client harm,” Mr Khalaf added.

“The fact that 14% of crypto buyers have borrowed to invest is basically terrifying.

“The extraordinary volatility and unsure lengthy-phrase outlook for crypto implies holdings can be wiped out, leaving debtors with nothing but their credit card debt as a memento.”