Bicycle-driving telecoms billionaire results in being BT’s most significant one shareholder | Company News

6 min readUnveiling BT’s whole calendar year final results, previous month, the company’s main government, Philip Jansen, designed apparent he felt the shares ended up a prolonged phrase financial investment.

For the 2nd consecutive year, he introduced an raise in spending in fibre rollout, disappointing some shareholders who would fairly have viewed BT concentrating on returns in the shorter run rather than promising jam tomorrow.

Right now, while, arrived proof that some traders in the broadband and telecoms stalwart are prepared to acquire a lengthier see.

Altice, the second-premier telecoms organization in France just after Orange (the renamed France Telecom), introduced it had snapped up a 12.1% stake in BT truly worth about £2.2bn.

It usually means Altice – which is owned by France’s ninth-richest male, Patrick Drahi – results in being the greatest solitary shareholder in BT, overtaking Deutsche Telekom, which has a 12.06% stake as a result of BT’s 2014 acquisition of the cellular operator EE, which was formerly portion-owned by the German huge.

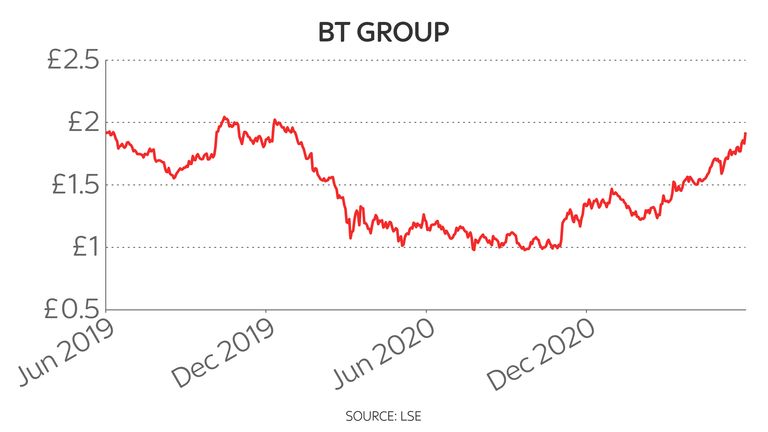

Shares of BT shot up by 3% at a person place to acquire them to their highest degree given that January last calendar year.

That was despite an unequivocal assertion from Altice that it has no intention of bidding for BT.

It stated: “Altice holds the board and administration group of BT in superior regard and is supportive of their method.

“Altice Uk has knowledgeable the BT board that it does not intend to make a takeover provide for BT.

“Altice British isles has made this sizeable expense in BT as it believes that it has a compelling chance to provide just one of the Uk government’s most critical insurance policies, particularly the sizeable growth of obtain to a comprehensive-fibre, gigabit-capable broadband network all over the British isles.

“Altice believes that the United kingdom provides a audio setting for significant lengthy-expression financial investment.

“This is supported by the latest regulatory framework, which gives BT the acceptable incentives to make the needed investments.”

In other words and phrases, then, the stake-creating appears to be a strong endorsement of and vote of self-confidence in the very long-term technique set out by Mr Jansen who, very last thirty day period, explained cash circulation would “go by means of the roof” once the the greater part of total fibre rollout experienced been finished in 2026.

BT responded: “BT Team notes the announcement from Altice of their financial commitment in BT and their statement of aid for our administration and system.

“We welcome all investors who recognise the extensive-time period benefit of our business enterprise and the significant job it plays in the British isles.

“We are building good progress in delivering our strategy and strategy.”

The emphasis from Altice that it is a prolonged term shareholder, fairly than trying to get to make a takeover bid, also displays a diploma of pragmatism.

The British isles federal government has not too long ago bolstered its capability to intervene in takeovers of organizations and significantly infrastructure that could be integral to countrywide stability.

As the owner of the UK’s largest fixed line and broadband community, Openreach, BT would surface to fall squarely into that class.

It tends to make it hugely most likely that the government would intervene were being any bidder for BT to emerge.

That is not to say that Altice will not request to impact what BT does.

Jerry Dellis, equity analyst at the investment decision lender Jefferies, advised purchasers: “A essential issue now is how Altice intends to unlock benefit.

“Encouraging an Openreach spin [off] looks most likely.

“A total takeover of BT or Openreach would be probably to run into political opposition specified the strategic importance of networks.”

And Mr Drahi, the billionaire founder and owner of Altice, is applied to getting his possess way.

This was emphasised to the outdoors globe when, in June 2019, he swooped to obtain Sotheby’s, the world’s most famed auction household, which experienced seemed poised to slide into the palms of the Chinese insurance policies billionaire Chen Dongsheng.

He has given that announced plans to set up his 26-calendar year old son, Nathan, as head of Sotheby’s Asia at the conclusion of the 12 months.

Likewise, Mr Drahi pounced in 2014 to purchase SFR, France’s second-biggest cell operator, from under the nose of the billionaire industrialist Martin Bouygues.

That enterprise now forms the bulk of Altice Europe, which also owns Portugal Telecom, the country’s largest telecoms operator.

It also owns the 2nd greatest telecoms operators in Israel and the Dominican Republic.

Apart from SFR, its other property in France consist of BFM Television set, the country’s most-viewed 24-hour rolling information channel and the radio broadcaster RMC.

Mr Drahi is also adept at pricing telecoms assets.

He acquired out minority shareholders in Altice Europe in January this yr, at a value of €3.2bn (£2.7bn), immediately after concluding it was undervalued by the sector.

He also is aware of about demergers, owning in 2018 spun off Altice’s majority shareholding in Altice United states, the cable and broadband operator, in response to considerations over the guardian firm’s credit card debt.

What is rather putting about 57-calendar year previous Mr Drahi is that, as opposed to the heads of quite a few of France’s richest enterprise dynasties, he is an completely self-made male.

Born in Casablanca, Morocco, his moms and dads had been maths academics and he did not go to France until finally he was 15 several years old.

Having analyzed at a single of the country’s major engineering educational institutions, Ecole Polytechnique, he joined the Dutch electronics huge Philips on graduation to perform in fibre optics.

It was in this get the job done that he first visited the United States and noticed how the cable industry was developing.

On returning to France, he launched his very first cable organization, Sud Cable Products and services, using a scholar financial loan, the equivalent of the time of about £5,000, as seed capital.

He went on to sell the organization to the US cable magnate John Malone 4 decades later, getting to be a multi-millionaire in the process, and going on to use the proceeds to set up Altice in 2002 with the intention of using it to consolidate cable and telecoms companies throughout Europe.

Mr Malone, himself just one of the industry’s most revered figures, has explained him as a “genius”.

Mr Drahi has been rumoured to have had his eye on BT for some time now.

The Mail on Sunday reported in August last 12 months that he was eyeing Openreach in unique and experienced “secured financial backing from heavyweight bankers at JP Morgan with a check out to spending £20bn for the unit”.

He is possible to continue to keep his enthusiasm in buying the stake in BT, who produced distinct right now that Mr Drahi had already spoken with Mr Jansen, to himself.

Mr Drahi, who with his spouse, Lina, has 4 kids, prefers to just take a lower-critical tactic.

With homes in Paris, Geneva, Tel Aviv and the US – he has French, Israeli and Portuguese citizenship – he offers few interviews and has been regarded in the previous to change up to conferences on foot or on a bicycle rather than, as most executives do, in a chauffeur-driven automobile.

One issue is crystal clear, though.

Existence at BT will be far more appealing with him on the shareholder sign-up.