Beware of ‘frothy’ US investment decision companies, LSE manager warns | London Inventory Exchange

4 min readA “frothy” US market place for so-termed “Spac” investment decision businesses could conclude poorly for some investors, with the trend a risk to United kingdom traders if programs to liberalise current market policies go ahead, in accordance to the chief govt of the London Stock Trade.

The proposals about specific goal acquisition corporations (Spacs) – “blank cheque” shell corporations that raise cash very first and seek out firms to purchase later on – were being introduced previously this week as component of a sweeping deal of reforms developed to attract additional speedy-escalating providers to checklist in London, in an attempt to keep the UK’s placement as a foremost world economic centre put up-Brexit.

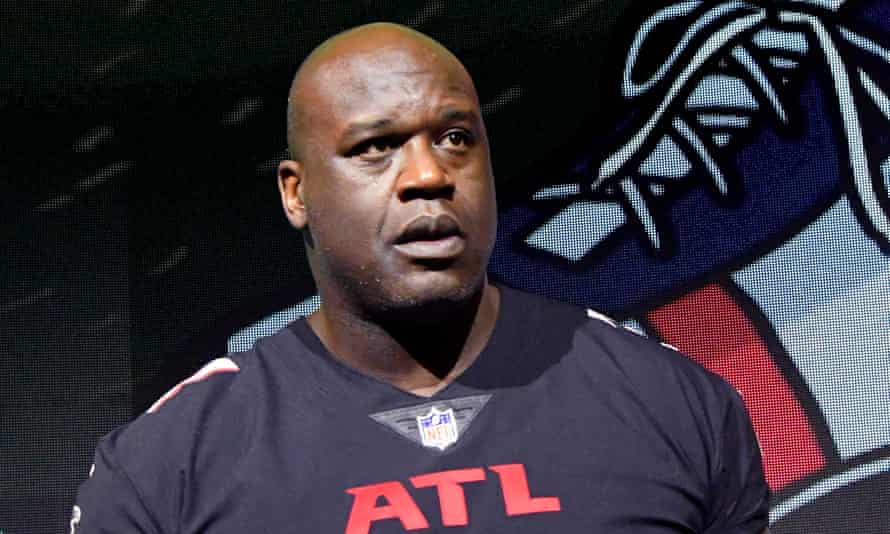

The popularity of building Spacs has proved to be a hot craze in world finance more than the previous calendar year. In January by yourself, new listings raised $26bn (£18.8bn) from traders in the US, virtually a third of the history $83bn collected by 248 Spacs in 2020. The basketball star Shaquille O’Neal, the former Cosmopolitan editor Joanna Coles and Martin Luther King Jr’s son have been among the those people involved in launching Spacs.

“I’m not the first particular person to say this but there is plainly some froth in the US marketplace for Spacs and some of that could stop improperly for some of individuals prospects and all those traders,” mentioned David Schwimmer, the chief govt of the London Inventory Trade Group (LSEG), when asked if he felt the Spac phenomenon is a bubble.

“I assume it is essential to recognise that Spacs are a handy tool in the cash marketplaces toolkit. They are just one way of companies finding access to public marketplaces in a way that is a tiny unique from an first public featuring (IPO). Getting mentioned that, I believe it is critical [to recognise] that we see speculative cycles in markets about the years. But Spacs do have a position to participate in and it is important traders and marketplace contributors use them thoughtfully and very carefully.”

Schwimmer welcomed the vast vary of measures announced in the evaluate, executed by the previous EU monetary services commissioner Lord Hill for the chancellor, Rishi Sunak. Actions include things like enabling dual-class constructions additional attractive to business founders hunting to hold manage immediately after listing, and reducing the amount of shares that should be bought to the general public from 25% to 15%.

“London is a terrific marketplace, the Uk is a terrific market,” Schwimmer reported. “We have a whole lot of fantastic organizations that have formed here, that have established up here, and simply because of some of the features of the [current] listing regime they come to feel that in some conditions tempted to go somewhere else, and we want to make certain we stay away from that temptation and can welcome them in this article.”

Schwimmer also claimed that LSEG, which is merging the functions of its £22bn acquisition Refinitiv, is reviewing its place of work house demands exterior London as it also looks to introduce a versatile doing work routine just after the coronavirus crisis.

Guardian organization email indication-up

“In the Uk we will certainly be maintaining our existence and headquarters in Paternoster Sq. and holding our existence in Canary Wharf,” he mentioned. “There are a amount of other locations that we have across the British isles that we are examining as section of integration scheduling. At the acceptable time we would like to be having our folks again into places of work. We will also have extra overall flexibility heading ahead. The pandemic operating ecosystem has shown that we can get a whole lot carried out with a extra adaptable doing work ecosystem.”

The firm reported it employed 3,927 employees as of the end of 2019. It has places of work in cities like Edinburgh, Exeter and Nottingham, as effectively as details centres in destinations across the Uk.

Earlier this calendar year, Amsterdam overtook London as Europe’s major share trading centre, which was perceived as a symbolic blow to the UK’s position as a fiscal powerhouse subsequent Brexit.

“This was effectively telegraphed, not astonishing and was a outcome of the share investing obligation underneath the EU regulation,” reported Schwimmer.

“I feel that there is no problem that London stays one particular of the world’s foremost world-wide money capitals. It carries on to have the power, the essential mass, the skills, the incredibly pragmatic and fair regulatory routine, and the authorized process relied on by firms and market members all more than the entire world. We as a global corporation headquartered in London sense quite at ease with its posture as a international economical cash.”