Andrew Bailey’s Maradona-like movements on interest amount route | Enterprise Information

3 min readFormer Lender of England governor Mervyn King appreciated to evaluate the location of desire rates to the dribbling of the late football legend Diego Maradona.

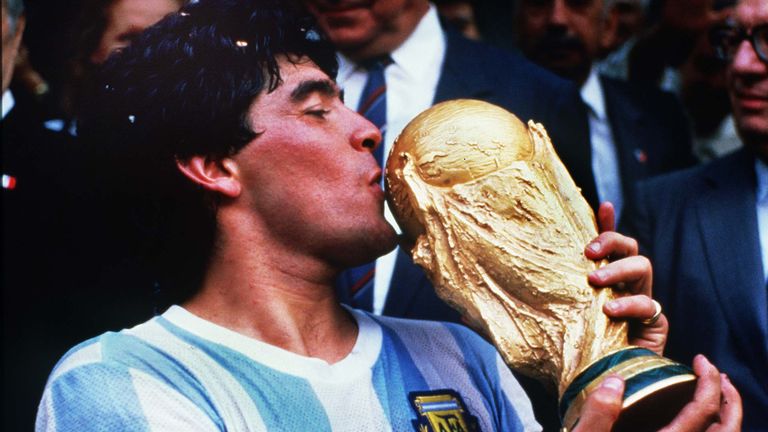

This wasn’t just for the reason that he experienced a routine of inserting gratuitous sporting analogies into most of his speeches. Feel of that renowned Maradona purpose in that notorious 1986 Globe Cup match versus England – the just one he scored with his feet relatively than his hand.

In that 2nd goal, regularly voted the finest of all time, Maradona dribbled past much of the England group before slotting the ball past Peter Shilton. It was a virtuoso efficiency, but King seen a little something fascinating. When you appeared again at the replays what you saw was that considerably from dribbling around players, drawing a mazey line in the direction of the aim, Maradona ran in approximately a straight line from the midway line to the purpose. Significantly from dribbling all over the England defenders, Maradona feinted this way and that although carrying on at precisely the very same angle.

Central bankers, claimed King, do a lot the same thing.

Even when curiosity rates are left unchanged for long intervals of time, the Bank’s monetary coverage committee (MPC) however experienced the energy to affect expending and activity in the economy by feinting this way and that.

To put it a different way, just hinting that it may possibly tighten monetary plan or loosen it could basically develop into a self-fulfilling prophecy, prompting homes to react as if the Bank experienced essentially improved desire fees.

What then, is a single to make of today’s news from the Financial institution of England? Fascination fees and financial plan remained unchanged but, as we know from Maradona, which is not the whole story.

And the most striking little bit of news right now appears a good deal like just one of people feints: the announcement that Britain’s financial institutions really should put together to be able to carry out destructive curiosity costs inside of 6 months.

On the one particular hand this appears pretty prudent: Lender charge is currently at .1%, which is currently the cheapest in its heritage. It are not able to genuinely get any lower devoid of hitting zero or likely down below.

Unfavorable fees – where by banking institutions theoretically pay shoppers to lend them dollars – are currently in put in some locations of the environment it is only right to discover out no matter if the monetary system listed here could manage it. The Bank’s conclusion is that it in all probability can.

But this is the thing: on the basis of the Bank’s forecast, in six month’s time the overall economy will be recovering fast from the current slump. In other text, it appears to be deeply unlikely that negative costs would be necessary at that level. If everything, rates may require to be lifted.

Which delivers us to the other fascinating bit of footwork from the Lender currently: it is also signalling that it may improve its assistance about when persons ought to anticipate a rise in curiosity charges.

Choose a step again and this appears to be like fairly odd. On the a person hand, the Lender is hinting we ought to be prepared for premiums to go under zero. On the other hand it is dropping a hint that we must be ready for fees to go up. Go figure.

In the function. Traders seemed to be most struck by the latter concept than by the previous.

In the minutes after the Bank’s Financial Plan Report was introduced, the pound strengthened – generally a signal that traders are betting on higher borrowing expenditures in the foreseeable future. In other words and phrases, what looks on the surface area of it like a dovish sign, as economists could call it, looks a good deal a lot more hawkish.