HSBC quarterly income surge on improved Uk economic outlook | Company Information

3 min readHSBC’s income have surged by a superior than envisioned 79% to $5.8bn (£4.2bn) in the initially quarter, mainly thanks to an improved financial outlook in the British isles.

The upturn authorized the banking huge to release $435m (£313m) that had been set aside to cover poor personal debt, boosting its bottom line in spite of a squeeze on revenues prompted by very low desire premiums.

HSBC had put apart a full of $8.8bn (£6.3bn) around the training course of final calendar year, such as just more than $3bn (£2.2bn) in the very first quarter, as the pandemic took hold of the world wide financial system.

The financial institution explained that the reduction in predicted credit losses (ECL) at the start off of this year was “thanks to an improvement in the ahead economic outlook, mainly in the United kingdom”.

It also observed a $3.9bn (£2.8bn) improve in home loan lending across the group, like $2bn (£1.4bn) in the United kingdom. The group’s HSBC Uk arm liked a financial gain of $1bn (£700m) all through the period.

“We are extra optimistic than we ended up again in February, we expect GDP to rebound in each economic climate in which we function this year,” main executive Noel Quinn told Reuters.

He cited the profitable rollout of vaccines in the US and Britain as a crucial element.

But Mr Quinn also warned that uncertainties remained.

The lender claimed: “There continues to be a large diploma of uncertainty as international locations arise from the pandemic at unique speeds and as government aid steps unwind.”

HSBC highlighted an array of hazards posed by the pandemic ranging from renewed outbreaks as well as tensions above entry to vaccines.

It also pointed to challenges from frayed relations in between China and the West and “dampened” small business sentiment in some components of the Hong Kong market – where by HSBC, which has a foundation in the territory, has been criticised in excess of its stance in relation to a political clampdown by Beijing.

Brexit also continues to be a stress and “may impression marketplaces and enhance financial chance, especially in the United kingdom”, HSBC stated, even though it also pointed to progress on talks aimed at easing cooperation involving Britain and the EU in fiscal products and services.

The team also pointed to a planned hike in the United kingdom company tax announced in final month’s spending budget, which it approximated would add about $150m (£108m) to its liabilities, as well as the opportunity for a further more strike from designs by Joe Biden’s tax strategies in the US.

HSBC’s earnings fell by 34% previous calendar year.

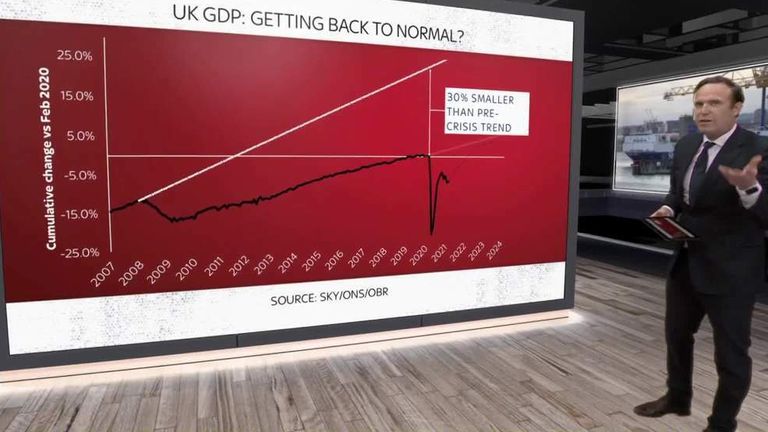

Its additional optimistic outlook for the British isles financial system now will come a working day after a forecast that GDP was on study course for its biggest yearly advancement considering the fact that 1941 this year.

That prediction, from the EY Item Club, was attributed to a additional resilient than predicted effectiveness by small business and individuals via most recent lockdowns, and hopes for a major boost as restrictions are lifted.

Past 12 months, the United kingdom suffered its most important once-a-year financial decline in a few centuries as GDP shrank by 9.8% many thanks to the coronavirus crisis – the most important slide amid the G7 superior economies.